Note: For a limited time the bonus on the US Airways Premier World MasterCard® has been increased to 50k miles!

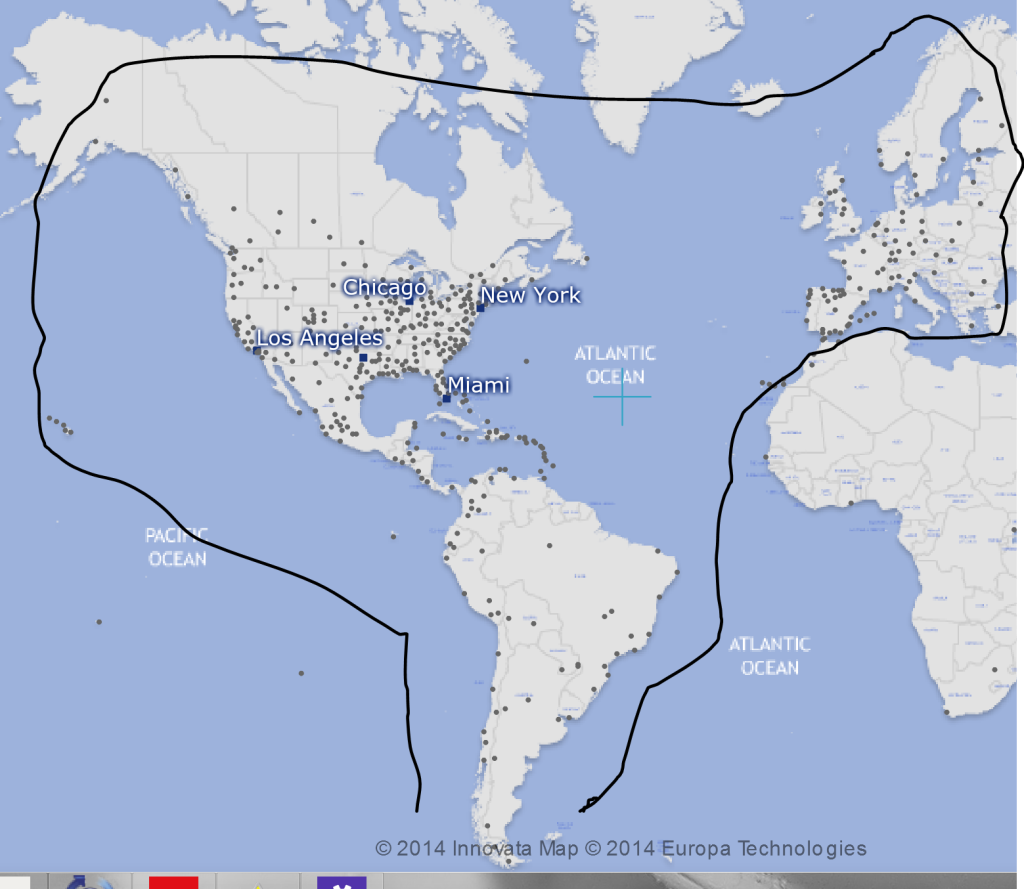

Where 40k AAdvantage miles could take you

This is a rough map of the destinations American Airlines serves which can be reached with 40k miles or fewer. By my count, there are 36 countries in the Americas and 28 in Europe. This means that if you can get your grubbies on 80k AAdvantage miles, you can start planning a trip to any of some 64 countries.

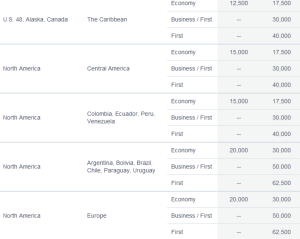

AAdvantage Award Chart

If you didn’t have friends like us, this idea of getting your hands on 80k AAdvantage miles would sound impossible, but this is something we do all the time, and something we’re not shy about sharing. In the past 4 years, I’ve accumulated more than 550k AAdvantage miles, and honestly I love the thought of you getting your share.

Before we get into that, I do want to say that there are some stipulations – you won’t be able to go to all of these countries at any time, because the redemption availability for the MileSAAver Level 1 (off-peak) awards do vary by date. Here’s the basic rundown on when these flights may be available:

- Hawaii: January 12 – March 13, August 22 – December 15

- The Caribbean and Mexico: September 7 – November 14

- Central America, Colombia, Ecuador, Peru and Venezuela: January 16 – June 14, September 7 – November 14

- Argentina, Bolivia, Brazil, Chile, Paraguay and Uruguay: March 1 – May 31, August 16 – November 30

- Europe: October 15 – May 15; Japan and South Korea: October 1 – April 30

I can tell you from experience that none of these are bad times to visit these countries. As a matter of fact, the crowds will be smaller and the prices will be cheaper.

Now, you were wondering about how you might be able to get 80k AAdvantage miles. Well, we’ll do you one better, let us show you how to get 90k.

How to get 90k AAdvantage miles

Here it is in its simplest form:

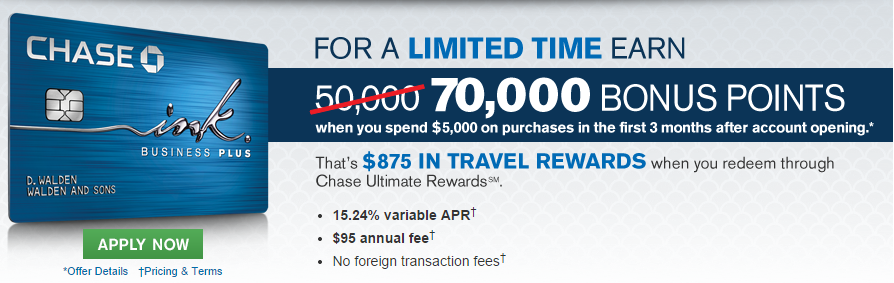

- Apply for the US Airways® Premier World MasterCard®, pay the $89 annual fee, make your first purchase, and you’ll receive 40k Dividend Miles which will merge with American Airlines AAdvantage in Q2 of 2015.

- Apply for the Citi® Platinum Select® / AAdvantage® World MasterCard®, no annual fee for the first year, use the card to make $3000 in regular purchases over the next three months, and you’ll receive 50k AAdvantage miles.

Mini FAQ (a longer FAQ post here)

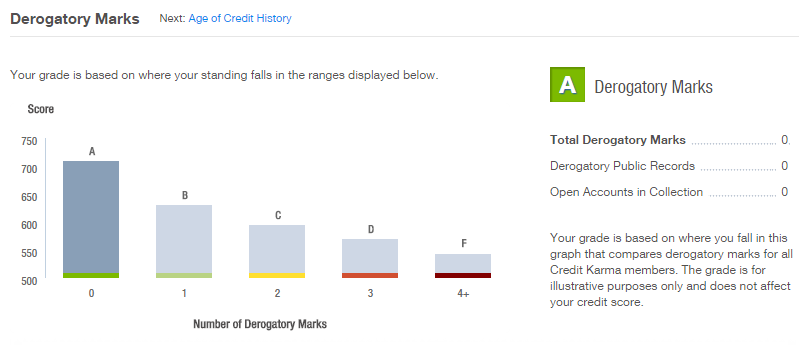

- Doesn’t it hurt my credit? We have an entire post dedicated to this subject, but the short answer is: not much. As long as you make your payments on time and in full, the impact to your credit score will be minimal.

- If I decide I don’t want to keep the card, can I still keep the points? Yes, the AAdvantage mileage program just requires “activity” every 18 months to retain your points.

- Is it impossible to find dates to use the points? American is actually pretty good about this – far better than Delta. The more flexibility you have, the better off you’ll be. Finding the MileSAAver level awards is certainly possible, though. Sometimes I use different airports and the nice thing about AA is that you can also fly into one airport and out of another one.

- Can I only fly on AA? No, AA is merging with US Airways and many of the flights available are still theirs. I’m flying to Hawaii on Alaska Airlines with AA miles. You can also find routings on Air Berlin, Iberia Airlines, and British Airways – though I don’t recommend flying BA in Europe because of their massive fuel surcharges.

- Is booking it complicated? No, AA.com is simple and intuitive. You won’t have any trouble using their online system – plus they allow you to hold an itinerary for 24 hours which allows you to pin something down and then think about it.

- Could I use all the points for a single Business Class ticket? Yes, as you can see in the award chart, the requirements for Business Class tickets are roughly double. If you’re in need of greater comfort, it’s certainly an option.

- Are there hotel cards that could get me free hotel stays, too? But of course. Click the category dropdown in the right sidebar and see all our posts on various hotel programs.

- Could my spouse apply for these cards, too? Yes, now you’re catching the vision, you greedy wanderluster.

- How long will this last? Well, the US Airways® Premier World MasterCard® is most certainly on its way out. With the programs finalizing the merger next year, it won’t be around for long. The Citi® Platinum Select® / AAdvantage® World MasterCard® offer has been around for a while, but who knows when and how they may change it.

Are there other questions you have? Comment below. Where will these miles take you? Let us know what you’re planning.

I first learned about these guys after I had discovered CreditSesame. I thought I had died and gone to Hugh Hefners House when I found Credit Sesame, but Credit Karma was another level. The services and education offered by Credit Karma is far superior.

I first learned about these guys after I had discovered CreditSesame. I thought I had died and gone to Hugh Hefners House when I found Credit Sesame, but Credit Karma was another level. The services and education offered by Credit Karma is far superior.

We posted about this a long time ago

We posted about this a long time ago