Often our readers ask the question that many of you have asked yourselves as you’ve seen us write about this process of applying for credit cards to obtain hundreds of thousands of miles and points… “Doesn’t applying for these cards hurt your credit?”

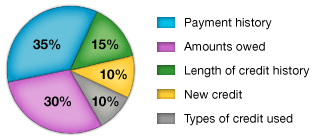

The short answer is: not necessarily. Your FICO credit score is composed of ratings given in five different categories. The number of credit cards you have and apply for really only factor into two of those categories: Length of credit history and New credit. Those two pieces make up only 25% of your overall score.

You can minimize the effect of any detrimental recent inquiries and a lower overall average length of credit history by maximizing the other, more important factors.

The pie graph below shows the weight that each of the categories carries on your overall score. For example, it would be much worse to be late on a payment, as it comprises 35% of your overall score, or to carry a balance on your card, which accounts for 30%. If you always make your payments on time, and in full, 65% of your credit score will be impeccable.

The two categories, in which applying for a new card could negatively affect you, are “New credit (inquiries)” and “Length of credit history.” Let’s talk about how to minimize the effect on those categories while still amassing an arsenal of frequent flyer miles and points through credit card bonuses.

Length of Credit History

If you are new to the world of credit you want to tiptoe around this subject. That is why we suggest that you get at least one “staple card” that you plan on keeping for a long time – a card that has a minimal annual fee, an annual fee that gets accompanied by an annual bonus, or no fee at all. We really like the Starwood Preferred Guest® Credit Card from American Express Card as a staple card. You’ll want to have at least one line well-established for some time before applying for many cards with big bonuses. It can look very risky to a creditor if someone is opening a lot of lines of credit without first proving that they will actually be a faithful payer.

If you have already had credit cards, a mortgage, car loans, and other forms of credit that have been established for several years, then a few new accounts is not nearly going to seem as risky to the credit card companies. Your score will be more resilient to inquiries.

Keep open the cards and the lines that you’ve had for a long time as it helps you increase your average credit history length. Let’s just say that you’ve had your mortgage for 10 years, a car loan for years, and a credit card for 10 years then your average length of credit history is 7.67 years.

This category comprises 15% of your overall score. This is a relatively small portion, but you want to do everything possible to ensure that this piece remains strong despite adding accounts that you’ll likely cancel before the annual fee comes due. On this note, we’ll also remind you to keep your cards open at least for the first 11 months. Most cards charge an annual fee, but it is generally waived for the first year. I would recommend that you keep the card at least until the annual fee is due, and then cancel. Many times when you attempt to cancel a card, the customer service reps will offer to waive the fee or offer another retention bonus if you’ll keep it open. If you get that invitation and it’s a good deal, take it. You’ll extend that card’s average length by another year and help your score.

New Credit

This category comprises only 10% of your overall score. Some estimates say that each credit inquiry takes 3-5 points off of your score. This will vary greatly depending on your history, but generally it does not have a major impact.

Remember that credit scores range from 300-850. 850 is the highest possible score and anything under 500 is horrible. You want your credit score to be above 700, and preferably over 730. Anything over 730 is widely considered “excellent.” There is no differentiation for most loan rates and other credit determinations for anything over 730. What that means is that you have all kinds of room between 730 and 800 to sacrifice a few points here and there in exchange for some massive travel bonuses.

The impact of these credit inquiries becomes even less important when you consider that there are actually three credit bureaus keeping your credit score, and card issuers don’t always make an inquiry with each of them – most often they only draw from one. Keep track of all inquires that are getting reported on your credit report with a service like www.CreditKarma.com.

For example, I applied for the American Airlines Citi Visa card in September of 2010. They made an inquiry with Equifax to check my score. Equifax, then, is the only one of the three agencies that recorded the inquiry in my score. Transunion and Experian have no knowledge of it, but there are inquiries that each of them have that Equifax doesn’t. I might apply for 9 cards a year and have no more than 4 recent inquires with any one credit agency at any given time.

Furthermore, “new credit” inquiries fall off every two years. So I get a clean slate with each agency every two years – a slate which of course I instantly dirty with a round of new applications and travel bonuses that will help me see the world the “free-way.” At times, we have even done “App-o-ramas” – applying for as many as 5 cards in one day and obtaining more than 300,000 miles and points at a time.

Could More Cards Actually Help my Score?

In the past two years, between my wife and I, we’ve applied for and received bonuses on 23 different credit accounts. When we began, my credit score was 767. When I recently had my score checked, it was 794. One factor is that I drastically increased the dollar value of my available credit, while adding no debt. Also, I have more lines that demonstrate a flawless payment history. Those are the pieces that truly matter.

Am I saying this will be the case for you? Again, not necessarily, but it has been for me. I fully anticipate that over time I’ll draw that down with more inquiries, but I’ll never ever compromise the 730 level.

—-

I want to reiterate that we are not offering you financial advice on this site. We’re offering travel advice. While we love to see you embrace the idea and see the world the “free-way,” we’d never want to see you hurt your credit or your financial standing.

If you have balances on cards, this is not for you. I’ve never paid a penny in credit card interest, and we don’t want you to, either. If you can’t responsibly make every payment early or on time, this is not for you. Please read our post on Before you Apply and if you feel comfortable, start wanderlusting with us.

Our “Loop Posts” are a great place to get started thinking about what all these miles and points can do for you.

If I open a card that has an annual fee that is waived the first year and then want to cancel after a year, what happens to all the points I have earned? Do I have to use the points before I cancel?

Melissa,

Great question!

I’ll answer your question in my post tomorrow!

Melissa-

Now, that’s just the beauty of it. That’s exactly what we’re urging you to do. In all of the cards we’ve applied for and received, once we’ve been given the bonuses, they’re ours to keep regardless of whether we keep the card. We can’t say that every single offer will work this way, but they’re bound to honor their commitment.

Because one element of your credit score is the length your lines of credit have been open, we’d urge you to keep them open as long as possible before closing them. In many instances, when you do decide to close a card, they may offer you additional benefits to keep the card open, and you’d just have to weigh the cost vs. the benefit.

In fact, I even signed up for two Chase United Mileage plus cards with $95 (first year) annual fees because it felt like

it was worth it. Once I got the cards and met the spending requirements, I asked them to waive the fee, and on one of the two cards they did without hesitation. No luck on the second, but I figure that $95 for enough miles to fly to Europe is not a bad deal.

The other key that you’ll find in all of our posts is that we make it a point to use these cards as if they were debit cards. The moment you start paying interest and late fees on these credit cards is the moment they start playing you instead of you playing them. You have to be diligent in making only purchases you would make with cash, and paying off your expenses right away. You can read more in our post – Before you apply

Thanks for wanderlusting with us. Keep visiting and hit us up with any more questions you might have.

Brad

Pingback: Reader Feedback and www.annualcreditreport.com | WorldWanderlusting.com

Pingback: Join our Facebook Group! | WorldWanderlusting.com

Pingback: Upgraded to Delta Skymiles Platinum Card | WorldWanderlusting.com

Pingback: Eight Great Bridges Around the World | WorldWanderlusting.com

Pingback: From Wanderlusting to Wandering – Los Cabos, Mexico | WorldWanderlusting.com

Pingback: How to Save $4,000 on your European Vacation | WorldWanderlusting.com

Pingback: Capital One 100,000 Double Miles ChallengeBonus Offer | WorldWanderlusting.com

Pingback: Your Spanish Dream Vacation, Courtesy of Chase Credit Card Rewards | WorldWanderlusting.com

Pingback: Learn How to Save Money on Travel and Vacation with World Wander Lusting! - Coupons Are Great

I like to apply for a few credit cards every few months. I’ll apply for my husband and 3 months later apply for myself, and back and forth. That way, we always can get the best new sign ups that have come out and not get too many hard inquiries on either of our credit reports. My goal is to get all the amazing Chase cards, with the Ink being the last on my list.

Miriam, That is great. Chase definitely has the majority of the best deals right now. I only wish some of the other banks would come out with competitive offers like Chase has been doing. Chase could probably lower their offers and still be the most competitive, which makes me wish that others would bring out some good offers.

That is a great strategy for applying for the Chase cards. Being cautious is always important. Thanks for wanderlusting with us.

Pingback: Staying 8 Free Nights near Universal Studios Orlando | www.WorldWanderlusting.com

Pingback: I Want to Fly to Orlando for Free |

814 score dropped 36 points this month after putting $2000 per mo.( for 2 months) on ink bold to reload prepaid card. Never carry a balance. Simultaneously getting mortgage refi with no cash out, taking PI from$521 to $291. That and a car payment is all we have along with good income. Can you help me figure why they pounded me this way? Appreciate your insight. I was thinking of getting the ink plus but now I’m skitsy.

That was the only credit action you had over that period? What is your spending limit on the Ink Bold? Did you exceed 50% of your spending limit? Also, you know that the Ink Bold is a charge card, which must be paid in full each month, as opposed to the Ink Plus which is a credit card, right?

Other than those possibilities, it’s hard to say. Are you using a service like creditsesame to check your score (which only runs a similar model of your credit history to give you a score) or actually doing a credit pull? You’re checking with the same bureau? Because it’s easy to have a 36 point variance between bureaus.

Please let us know if you find anything out.

Brad

Pingback: Chase Southwest 2 Free Flights is Back |

Pingback: Meeting Minimum Spending Requirements: Vanilla Reload Cards |

Pingback: Share WorldWanderlusting

Pingback: Airline Flights to the Dominican Republic |

Pingback: Rules for Planning an App O Rama Credit Card Churn | Travel Tips For World WanderlustersTravel Tips For World Wanderlusters

Pingback: Disneyland Vacation for $509 - Not a fantasyTravel Tips For World Wanderlusters

Pingback: Hotel Hopping on a Tour of Great BritainTravel Tips For World Wanderlusters

Pingback: LDS Church History Tour: Free Flights and Free Hotels | Travel Tips For World WanderlustersTravel Tips For World Wanderlusters

Pingback: Travel the Free Way: Frequently Asked Questions | Travel Tips For World WanderlustersTravel Tips For World Wanderlusters

Pingback: Almost-Free Vacation to Europe: 2 Flights and 9 Nights, Pay No More Than $160 - Travel Tips For World Wanderlusters

Pingback: How to Manage All These Cards, Accounts, and Points | WorldWanderlusting.com

Pingback: From Wanderlusting to Wandering: Italy | WorldWanderlusting.com

Pingback: Find a $15,000 Treasure Chest of Free Travel | WorldWanderlusting.com

Pingback: How the AA/US Airways merger could get you 2 tickets to any of 64 countries | WorldWanderlusting.com

Pingback: Great New Offer on The US Airways® Premier World MasterCard® | WorldWanderlusting.com

Pingback: Traveling to Paris, France for under $500 | Cooper Travel