Lately it feels like we’ve been connecting with readers on a level we’ve craved for the three years we’ve been running this blog. It seems that all of the sudden, people who have been reluctant to take the plunge finally realize the opportunity that lies in taking advantage of opportunities to accumulate miles and points for almost-free travel.

Once someone finally enlists in our army of wanderlusters, their next question is almost invariably, “How do I manage all these cards, accounts, and points?” That is a great question because the reality of all this is that if any of it comes at the cost of destroyed credit, debt balances, and expired points, it just won’t be worth it. But with technology what it is today, none of this is very hard at all. I’ll make it real simple for you and tell you exactly what I do.

Managing all the Credit Cards

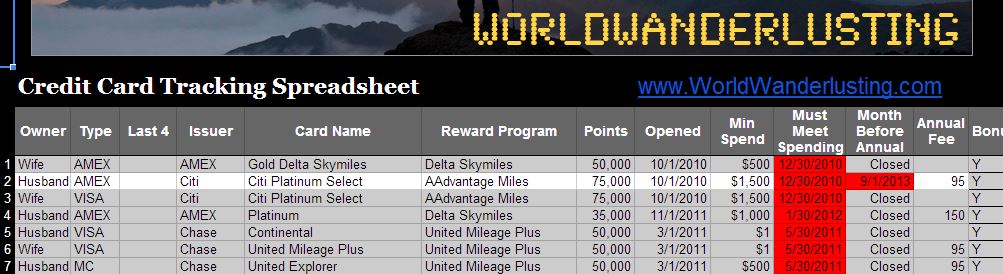

I keep a Google Docs Spreadsheet of each card I have, when I applied for it, what the bonus is, how much I need to spend, etc. I can update this from any of my computers and it also serves as an ongoing record of what I’ve done. I am going to be making this spreadsheet available in the next couple of weeks to all fellow wanderlusters who have subscribed to the blog (which you can do by entering your email in the right sidebar).

Subscribe to our blog to get access to the Credit Card Tracking Spreadsheet

The other thing I do immediately upon being approved for a card is to set 2 reminders in my Google Calendar. I put one reminder 2 weeks before my minimum spending requirement and another reminder 11 months after applying to remind me to call and ask about having the annual fee waived and/or canceling the card.

I recently had a reminder pop up to cancel my Frontier Airlines World MasterCard® and they were kind enough to move the account to a no-annual fee card and allow me to keep my account open (extending my history and improving my credit score).

I also had a reminder about meeting the min spend for my Southwest Airlines Rapid Rewards® Premier Card. The deadline got so tight I actually had to go buy a $175 Walmart gift card which we used to buy groceries with a week later when we had the time to go.

This way I always have a firm grasp on what cards I’ve had, which are open, what spending requirements I might have open and which cards could be coming up for annual renewal.

In terms of managing the physical cards, I keep only one on me at all times and only accumulate spending on one card at a time. I keep the rest of them in my desk drawer with any sticky notes and permanent marker notes on the ones I have closed. It’s actually quite the impressive stack and I can’t bring myself to throw any away.

Managing the Accounts

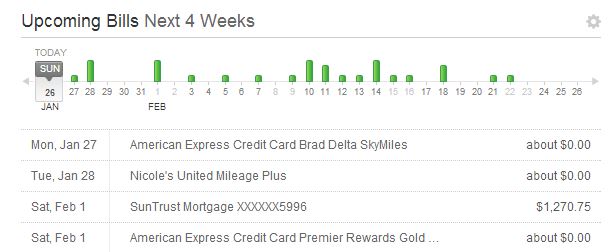

This is the part that is most freaky for people. And if I had to rely on paper bills, I, too, would be terrified. This is actually the easiest part, though, because of a miracle online software called Mint.com. I enter all my logins and passwords to Mint.com and it consolidates every account I have – from my 18 open credit card lines to my mortgage and 401(k) balance.

This way I can always see if any of my cards have a balance and ensure that they are all paid off well in advance of any due dates. I can look at my transactions on an individual account basis, or universally across all accounts. I can also weigh my spending against my budgets and track my net worth. The crazy thing is that it costs me absolutely nothing.

Managing your Credit

Another scary monster that often keeps people from joining the ranks of we, free travelers, is the fear of having to manage and mitigate the effects of this behavior on one’s credit. This is really something you ought to do whether you’re applying for 10 credit cards a year or not.

I have enrolled in two online programs which run algorithms on my credit history to estimate my credit score. These are www.CreditSesame.com and www.CreditKarma.com.

I just pulled this sample from my CreditKarma login, which theoretically gives me a score similar to what my Transunion score might be. As you can see, despite applying for 10 cards personally in 2013, I’m sitting at 775. We talk more about this in our “Doesn’t it Hurt My Credit?” post. The short version is that the real important parts are to never carry a balance and to always pay ahead of time or on time.

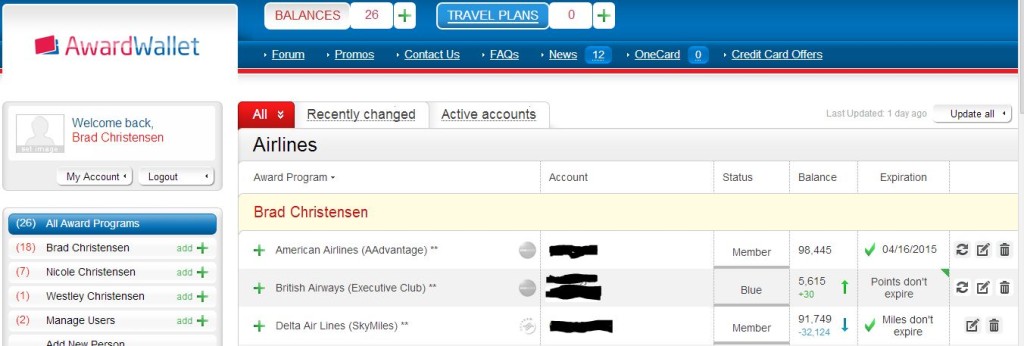

Managing all these Points

Now for the fun part. What’s the reason we’re doing all this? To create a warchest of anti-monotony weapons of mass destruction. Most of these points won’t expire as long as you have periodic activity on your accounts, but it’s important to know what you have so that planning your travels is fun and easy. Awardwallet.com makes this so simple and it really is a treat to get your points hoarded into a single “bank” where you can count them and make plans for them.

This is precisely where you go the moment a cold snap hits your hometown in Idaho, or the moment your workplace becomes overly tedious. This is your escape hatch to free travel and you want to be sure that all of your various programs are feeding into this site. You can also download the app and use it to reference your account numbers whenever you need them as well.

I guess all that leaves is for you to manage your vacation days – manage them well! And let me take this moment, too, to say that it is all worth it, and to urge you to make travel a part of your life – especially free travel – it’s even more rewarding.

Thanks for wanderlusting with us!