Credit for most people feels like a mystical world that nobody understands. Most people have very little understanding of what their score is and how it works. After studying this topic for the last couple of years I’ve come to know quite a bit about credit scores. There are many things that you can do in order to earn and to keeping a good credit score. Let’s review.

What is a Credit Score?

When you want someone to lend you money, that lender must do research on you to make sure that you’re faithful about paying your bills. What the lender wants is a reference from someone, who isn’t partial to you, to tell them if you’ll pay the debt back or not. Lenders share information on each of us so that there’s a reliable source they can look to to determine our creditworthiness.

You’ve actually got three credit scores. There are three companies that track your reliability in paying your bills. They are Equifax, TransUnion, and Experian. All three of these companies are like Santa Claus in that they know when you are naughty and nice (when you pay on time and when you’re late).

The score tells the lender in a very simple code if they trust you or not. The higher your score, the more they trust you. The scores range from 300-850 but they’re generally judged in tiers – more on that below.

How do they figure my credit score?

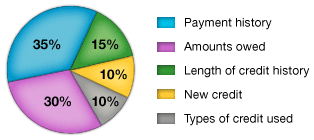

These three companies monitor five key areas when they calculate your credit score. The five categories are:

That’s it. They tell you exactly what percentage of importance each category has. Paying people back on time is the most important thing you can do to improve your score. Nothing will damage your score more than missing a payment.

You also want to make sure you’re paying your balances in full every month. It will do you NO good to score millions of points and miles if you’re keeping balances and paying high ridiculous interest rates. It’s also important to not let your statement close with more than 50% and ideally more than 33% of your available credit used. Example: If your credit limit is $10,000 and you spend $9000 in one month it looks bad. Imagine if you were the lender and saw the guy who wants a loan hitting his maximums with the guy next door. It would make you nervous too.

Length of Credit History is the average of all of your credit histories amongst all the accounts you’ve ever had. This is why we recommend that you keep your cards for at least a year, if not more.

So many people believe that applying for new credit will drop your score. Below is a quote directly from the myfico.com website that debunks this myth.

Fallacy: My score will drop if I apply for new credit.

Fact: If it does, it probably won’t drop much. If you apply for several credit cards within a short period of time, multiple requests for your credit report information (called “inquiries”) will appear on your report. Looking for new credit can equate with higher risk, but most credit scores are not affected by multiple inquiries from auto or mortgage lenders within a short period of time. Typically, these are treated as a single inquiry and will have little impact on the credit score.

What is a good credit score?

Most lenders look at a score above 720 as an A credit. Obviously I don’t work for a bank, but the general rule is that as long your score is over 720 you’ll get the same interest rate as someone sporting an 840. Sure there are exceptions to that, but overall you want to have a score above 720 with all of the crediting agencies.

Remember that in order to get approved and pile up bonus points with these credit card companies you must have an established credit history. In most cases, they won’t approve you for their amazing offers if you haven’t proved yourself first. If you’re new to this, and you don’t have an established credit then I recommend you start with a beginner card at your bank. This card should NOT have an annual fee and it should be a credit card that you plan on keeping for a long time (to stretch the average length of your credit history).

How will having a good credit score help me?

First of all, it will help you to get lower interest rates on any loans you might need. This is crucial so you pay the least amount possible. I just applied for a mortgage this month and my scores looked like this:

- Experian: 788

- Equifax: 788

- TransUnion: 780

My wife’s looked like this:

- Experian: 758

- Equifax: 765

- Transunion: 758

You’ll notice that the three scores are generally very close together. We’re stoked because we’ll be getting a 3.375% interest rate on our house, but at the same time within the last two years we’ve applied for 9 credit cards between the both of us and we still have strong credit scores. I’ve been keeping things cool until we got this loan approved as of late, but those 9 credit cards along with other promotions have earned us over 700,000 miles and points.

Those points have easily saved us over $10,000 in the last two years and that… my friend… is the real reason why you need to have a good credit score.

Keeping a Good Credit Score

Keeping a good credit score will benefit you throughout your life. Make sure you make good decisions every time you apply for a credit card or a loan. Never make purchases on a credit card that you would not otherwise make. Monitor your accounts responsibly and never miss a payment. As you look forward to 2013, make sure you have a couple of important goals:

- Travel more than you ever have before

- Keep a good credit score

May 2013 bring you both of these things as you continue to worldwanderlust with us!