I had a streak in college when I “broke bad.” I was a straight-up kleptomaniac for about a week. I went from being the kid who felt immense guilt over yoinking a pack of bubble gum, to a guy who shamelessly stole Christmas gifts for every member of his family. It started out with stuffing a pair of snowboarding mittens into a box of boots I was already buying. It was a dishonest, homemade version of “buy-one-get-one-free,” and I justified it despite knowing it was wrong.

At the peak of my depravity, I walked into an office supply/shipping store and picked up a $24 Rand McNally Road Atlas off the shelf, walked back to the back of the store, put it in a large envelope, and paid $4.50 to mail it to myself.

While I’ll admit that I’m still a little awestruck by my own clever methods, I’m not proud of those days. And while I’m as value-conscious as I’ve ever been, I’m a reformed man. At least, I think I am. You see, now I get my “five-finger-discount” on the biggest of my spending categories – travel – and I get it by understanding and using loyalty point programs.

It doesn’t sound as flashy, but I’m telling you, it’s a colossal heist. Here’s a taste. In the past three years I’ve stayed 49 free nights in hotels. I flew my family of six to Panama for $261 out-of-pocket. My wife and I just returned from a 2-week trip to Italy that we booked for 40,000 points and $81 each. I could go on and on, but you’re catching the vision.

You see, most people think they’re already playing the frequent flyer mile game… but they aren’t even in the stadium. There is a world of travel-hacking out there that would astonish you… and the fact that you have an Alaskan Airlines credit card is only getting you started. There are people like me who are hoarding loyalty points aggressively (chubby-kid-under-the-piñata style) and I want to invite you to become one of them.

Here’s my Five Finger Formula:

1. Understand the Programs

The first key to taking advantage of loyalty programs is, of course, to understand them. It’s not nearly as intimidating as you’d think. To begin, know that there are essentially three forms of travel rewards you can accrue:

The first key to taking advantage of loyalty programs is, of course, to understand them. It’s not nearly as intimidating as you’d think. To begin, know that there are essentially three forms of travel rewards you can accrue:

- Airline Miles: You probably belong to at least one of these programs – Delta Skymiles, American AAdvantage, Southwest Rapid Rewards. These are the most visible of all loyalty points and they’re a key to making free-travel happen.

- Hotel Points: Similarly, hotel chains offer loyalty programs that usually span a few different brands. Ones that may be familiar might include the Marriott Rewards program or Hilton HHonors.

- Bank Points: These are generally deeper in the shadows, but they are supremely powerful because often they can be transferred to various other programs or spent like cash. Examples include American Express Membership Rewards, Chase Ultimate Rewards, and Barclaycard Arrival Points.

Now that you know that there are programs in each of these categories, consider that you can obtain points a few different ways:

- Direct Usage: Airlines usually give you miles for every mile you’ve flown and hotels give points based on the number of dollars spent. This is a painfully slow way to accumulate points. If you consider that a domestic flight is typically 25k points and the US is about 3,000 miles wide, you’d need to do at least 4-5 RT flights from coast to coast in order to have enough for a free flight.

- Per Dollar Spending on Credit Cards: If you have a business that is heavy on inventory or that makes other large-dollar purchases that you can pay with a credit card, this is a great way to build points, yet most of us are not that fortunate. I find that I can spend about $1000-$1500 per month in everyday expenses, also making the accrual to free-travel levels achingly sluggish.

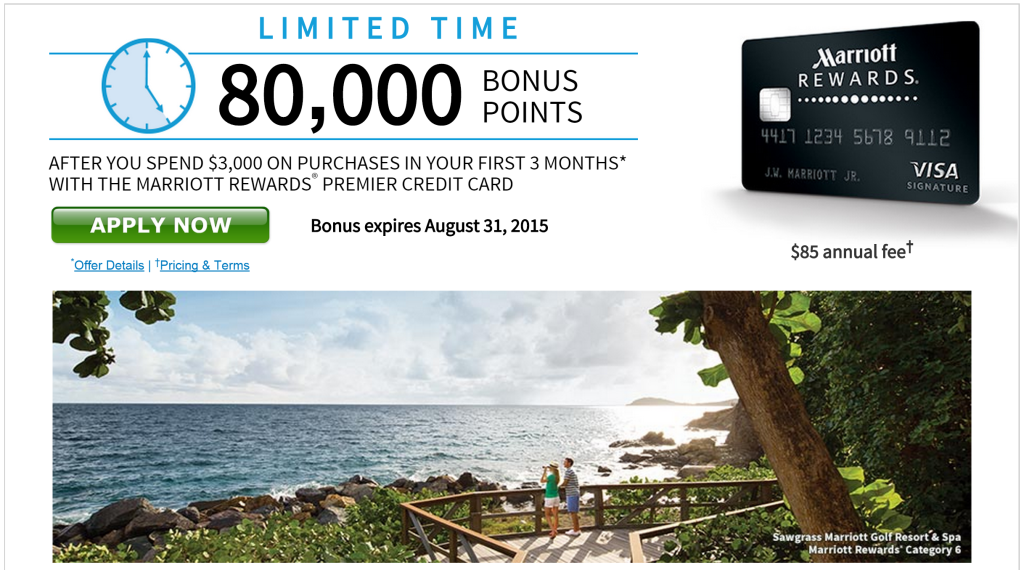

- Upfront Bonuses from Credit Cards: For me this has been the rainmaker. In the past 3 years, between my wife and I, we’ve applied for 34 credit cards and racked up more than 2,200,000 loyalty points across a number of platforms. This is not for everyone as it does require discipline, but it is so insanely worth it.

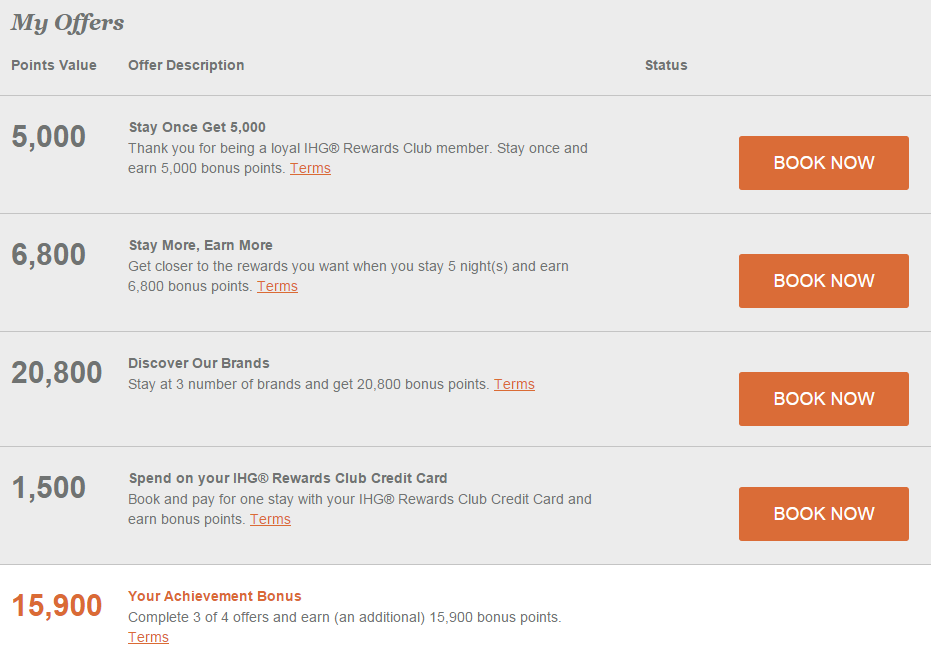

- Promotions: Loyalty programs are about creating… you guessed it… loyalty. What they want to see is you look to their brand first when making travel plans, and they get that by helping you love what they offer. Often programs will run special programs to bump your balances. You need to know about these.

- Transfers: Some programs like the Starwood Preferred Guest will even allow for specific transfers, but usually these come from the bank points we mentioned above. It’s especially nice to make transfers when they’re offering multiplier bonuses.

- Buying Points: I almost didn’t include this because more often than not, it’s not a plausible thing to do, but every once in a while, they make it worth it.

2. Sign Up for Them

You don’t need to go out and sign up for a bunch of credit cards right away, but there is no harm in enrolling in the loyalty programs for airlines and hotels.

You don’t need to go out and sign up for a bunch of credit cards right away, but there is no harm in enrolling in the loyalty programs for airlines and hotels.

Do yourself a favor and create a single username and complex password that you’ll use to register for all of the programs. Email yourself the account numbers once you’ve registered and keep them in a special email folder. By doing this you’ll also be piped into special promotions they’ll email from time to time.

Also, this way you’ll always be ready in case you happen to fly on an airline you don’t normally use or stay in a hotel you weren’t a member of. Commit that you won’t allow opportunities to fall by the wayside. I have friends who are crazy about travel and yet somehow they allowed 17,000 miles to go uncaptured after flying to China without registering for a program. [gagging sound] Don’t do that to yourself.

Also, create a stream of ongoing points and miles education by subscribing to some blogs. Obviously we’d welcome your subscription to WorldWanderlusting.com and we’d urge you to check out MillionMileSecrets.com and the forums at Flyertalk.com. This way you’ll always be aware of what’s happening in the Miles and Points world.

3. Get Some Points Coming

Maybe you’ve already got some built up… perfect, that’s a good start, but good is an impediment to great. I want you to get a taste of what it feels like to be empowered by an awardwallet that is brimming with opportunity.

My favorite “getting started” strategy right now is to begin piling up points with the Barclaycard Arrival World Mastercard. It’s super simple to redeem the points – just reimburse yourself for travel purchases. The up front bonus is healthy – you get $440 in free travel after spending $1000.

Aside from that, make a determination about which programs best suit you. If you fly Southwest Airlines often, search out some ways to pile up Southwest Rapid Rewards. If you love staying in Starwood Hotels, get the Starwood card that offers a bonus of enough points to stay as many as 8 nights in Category 2 hotels after meeting the minimum spending requirement.

4. Know How to Value Them

This is easily the most challenging part – travel points are currency, and as such, their value is variable. The most confusing element for people is the concept of “miles.” They’re referred to as such because historically airline miles have been accrued on a “miles-flown” basis. But with most programs redemption has little to do with distance flown. Because I always think in terms of maximum value, these figures are for the lowest possible redemption for each program. You can pay much more in points than this, but these are baseline figures for the lowest amount you can get away with.

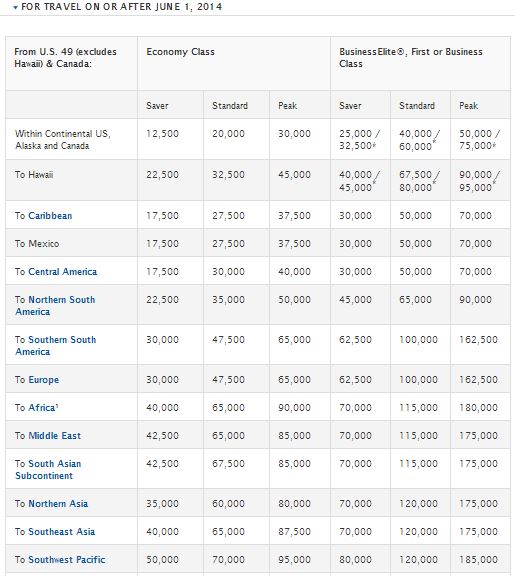

Here’s how redemption breaks out for most airlines:

- Domestic flights are generally 25k points on the major carriers. The exceptions are Southwest, whose redemption is directly relative to the cost of the flight (~70 Rapid Reward points per dollar on Wanna-get-away fares), and British Airways which does consider the length of your flight in valuing redemption (making it an incredibly cheap way to book short flights.

- Central America/Caribbean/and Hawaii flights are 30-40k. Availability for these is best on American, Frontier, and US Airways.

- Europe and South America run between 40-60k. I think the greatest value in all of frequent flyerdom is the 40k redemption to Europe on American between Oct 15 and May 15th. Getting $1300 flights for 40k miles is like an ultimate clearance sale. American Airlines is also an incredible value to South America, sometimes even offering flights for 30k points.

- SE Asia, Africa, Australia, and everything else are 60-100k. I like United for these kinds of flights. Delta works, too, but availability is scarce.

You can research each program on their individual websites, but we consolidated the links in our Using Airlines Miles page.

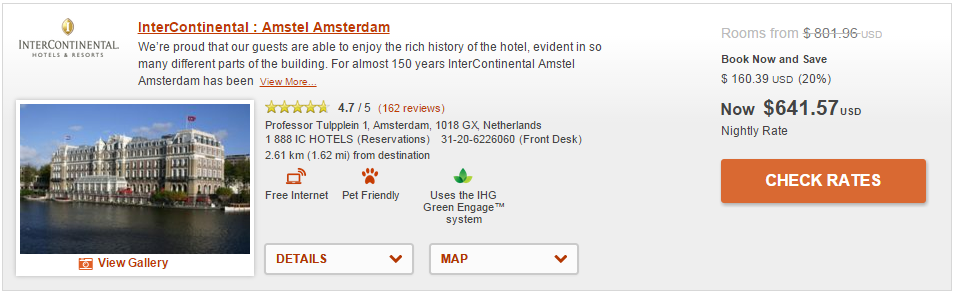

But getting free flights is just the cake. Free hotels? Now that’s the icing. The variance on hotel points is far greater, so it’s nearly impossible to create a value system that runs across systems.

The first thing you need to understand about hotel points is that all hotel chains divide their hotel properties into categories. The higher the category, the more points they call for. In most cases, Category 1 hotels are very few and far between. I always like to look at programs in terms of how many points it takes to redeem for a Category 2 hotel – that gives you a good baseline value to compare across the board.

Approximate points required for 1 night in a Category 2 hotel:

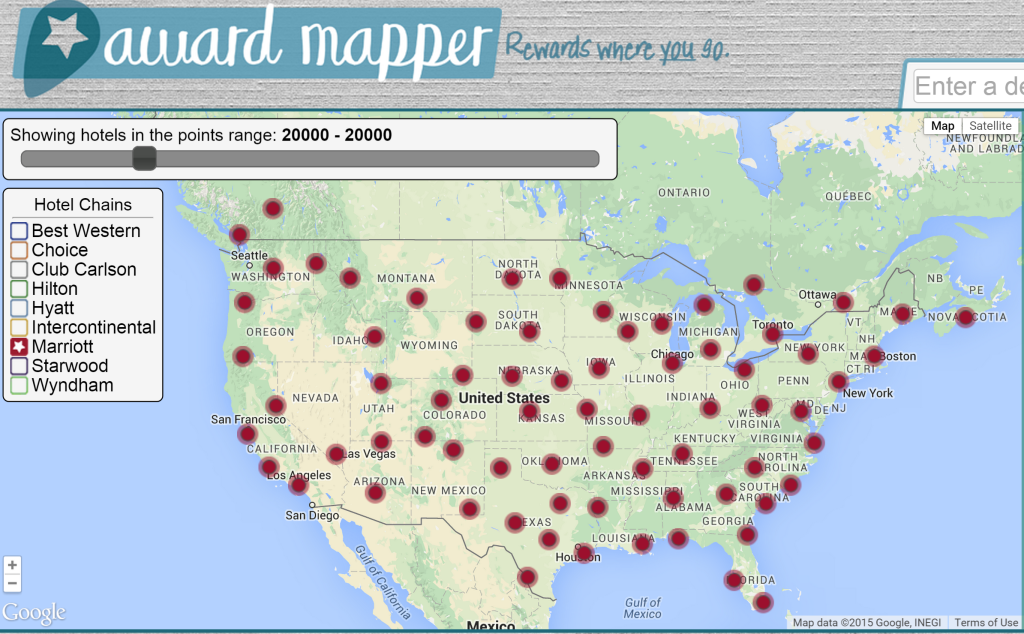

- Marriott Rewards 10k -Obviously there are an abundance of Marriott hotels across the globe. The best finds for category 2 hotels are right here in the US and in Spain, for whatever reason.

- Starwood Preferred Guest 3-4k (Sheraton, Westin, Aloft) – I used a few of these hotels in Italy and there are some good ones in popular vacation destinations in the US as well.

- Club Carlson 15k (Country Inn & Suites, Radisson) – This is my favorite program right now, especially because having the card they offer equates to a “book one, get one free” deal that really stretches the points. There are super nice category 2 hotels all over England and in a number of countries in Central and South America.

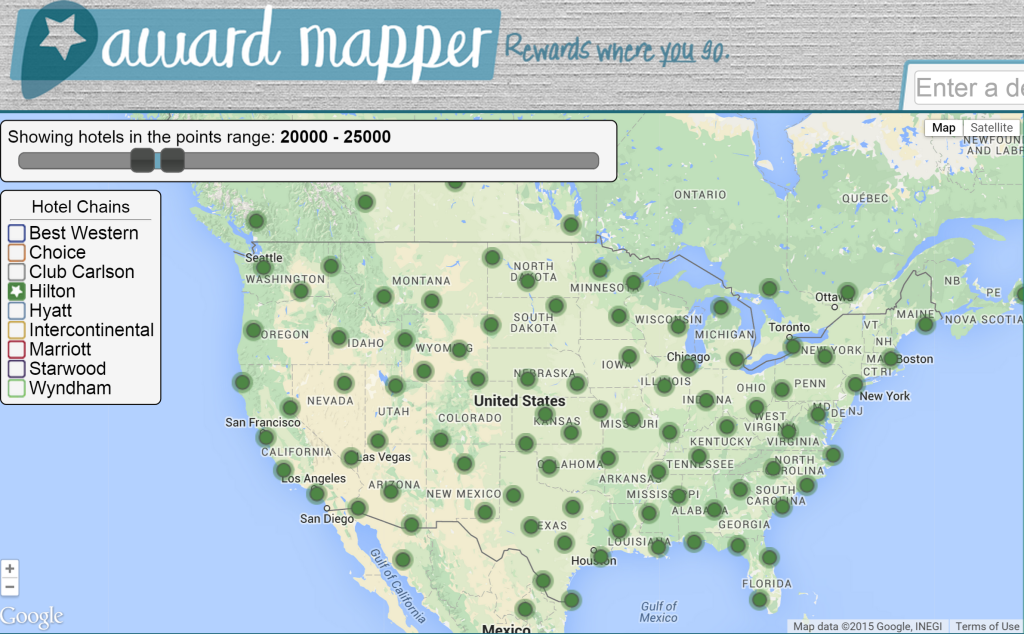

- Hilton 12.5k (Hampton, Doubletree) -I feel like this is the most overvalued chain, charging a lot of points that are tough to accrue for hotels that aren’t all that great.

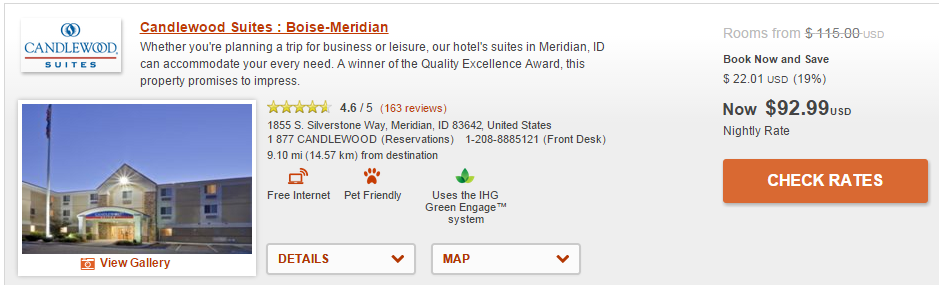

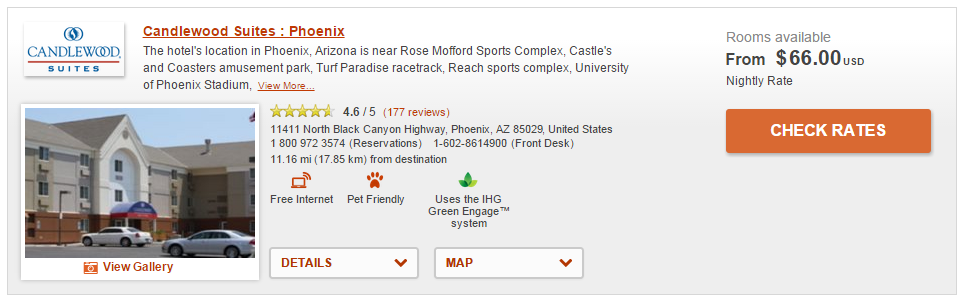

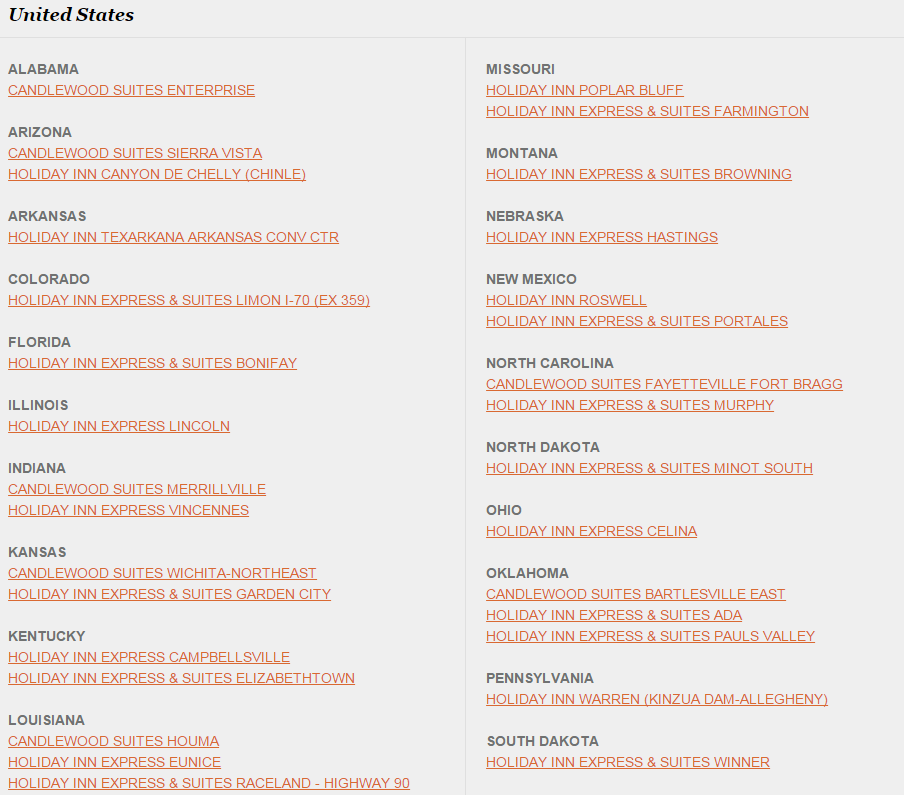

- Priority Club 15k (Holiday Inn, Candlewood) – You can search out category 2 hotels, but the best way to use these points is on their Point Breaks hotels that allow you to stay for only 5k a night.

- Choice Hotels 8k (Comfort Inn, Quality Inn) – This is a great option for free stays in good locations in large cities that usually require far more points from other programs – examples are Paris, Rome, London, Frankfurt, etc.

Now, you’ve got a stash of hotel and airline points that you’re greedily counting like Scrooge McDuck. All you need is a way to tie it all together – is it too much to ask for free car rentals and cruises too? No, it’s not, in fact. You can pull this off with Bank Point programs that have a portal that allows you to book these things for free, or that provide reimbursement for travel purchases. In many cases you can also transfer these points to hotel or airline programs to top off your accounts when you need a little boost.

Here are the major bank point programs:

- Barclaycard Arrival Points – I lead with this one because I love how flexible it is and how simple the earning capacity is. You earn 2 points for every dollar you spend and a 10% point kickback when you reimburse yourself for travel purchases. It equates to 2.2% cash back for travel, and that just doesn’t get beat.

- Chase Ultimate Rewards – This is another solid program with an option to use the points as cash at a 1.25 ratio. You can also transfer to a lot of other programs. There are a few different cards that you can use to pile up this kind of points.

- American Express Membership Reward Points – AMEX controls the market on business spending, so there are a lot of people with hundreds of thousands of these. I’d much prefer to have the others, though.

- Capital One Venture Points – Also a travel reimbursement program, this one is good, but it has been a long time since there have been big up front bonuses to lure me in.

Overall, the points are ultimately worth to you what you value them for. If you never want to go on a cruise, maybe the Barclaycard Arrival points aren’t all that great for you. If you stay with friends or rent vacation homes, maybe you’re better off to focus on airline miles over hotel points. The important piece is that you know what you want and go get them.

5. Know How to Redeem Them

All this is for naught if you can’t figure out how to use these points you’ve been gathering. There’s always the good old fashioned way of calling in, but unless your a pro at interpreting broken English and waiting on hold excites you, you’re going to want to book online.

All this is for naught if you can’t figure out how to use these points you’ve been gathering. There’s always the good old fashioned way of calling in, but unless your a pro at interpreting broken English and waiting on hold excites you, you’re going to want to book online.

I keep track of all my points in various programs with www.AwardWallet.com – it’s a handy tool that keeps me organized and feeds my wanderlust when I need a pick-me-up.

Every program has an online portal and booking with points is not much different from normal reservations.

We’ve done a number of instructional videos on our Youtube Channel, but fiddling around with it yourself is really the best way to get it accomplished.

When booking the most important rule is to be flexible. This is the real secret to using loyalty points efficiently. I always tell people, “If you want to use frequent flyer miles to go to Hawaii from December 23 to Jan 2nd and stay at a specific hotel, there’s a chance you could do it, but it’s going to completely drain you. If you want to go to someplace with a nice beach in the wintertime and stay in a clean hotel, you will be amazed by how much you can do with how little.”

Travel (real travel, as in, going places that are not occupied by cartoon characters) is about experiences. It’s about learning and living and loving. It’s about adventure and risk and excitement… and you don’t get any of that if you aren’t willing to break out of your comfort zone.

Your frequent flyer adventures will be so much cheaper, so many more, and so much more memorable if you’ll be willing to take what opportunities present themselves, rather than prescribing a necessary plan that they must conform to.

Here’s an example: Every quarter Priority Club releases their list of Point Breaks hotels – properties they let you stay at for 5,000 points/night. Since I have 85k, I could stay in one of those puppies for as many as 17 nights. Looking through the list I think, “Hmm…a Staybridge Suites in Valley Forge, PA… isn’t that where General George Washington knelt and said a humble prayer before leading the Continental Army to victory?” Guess who just booked a trip to Pennsylvania?

In Summary

As with any journey of a thousand miles, just as Lao-Tzu said, this one begins with a single step – a step in the direction of almost-free travel. Commit now to do more than casually collect frequent flyer miles and points. If you’re doing it right, it will feel like stealing – the exhilarating part, without the guilt. Just like travel itself, it’s something you’ll never regret.

Throw a dart at a spinning globe and if it lands in the blue, chances are there’s a cruise ship which sails somewhere nearby. As a means of choosing an itinerary for your first cruise, this probably isn’t the most reliable. But there are a few universal hints that can launch you on the right course to ensure those first-timer, rookie errors are ironed out long out before you leave home.

Throw a dart at a spinning globe and if it lands in the blue, chances are there’s a cruise ship which sails somewhere nearby. As a means of choosing an itinerary for your first cruise, this probably isn’t the most reliable. But there are a few universal hints that can launch you on the right course to ensure those first-timer, rookie errors are ironed out long out before you leave home.

We clambered on all four limbs until we came to “the eye of the needle.” On other hikes I’ve heard spots like these referred to as “fat man’s misery.” You get the point… it tested our flexibility.

We clambered on all four limbs until we came to “the eye of the needle.” On other hikes I’ve heard spots like these referred to as “fat man’s misery.” You get the point… it tested our flexibility. The task at hand was now to work our way across two roped traverses – one named “the belly roll,” and another named “the crawl.” With the wind now whipping wildly, it had gotten cold and the slow going only made it worse. Even still, we made it across, and then worked our along another roped route, this time a vertical chimney.

The task at hand was now to work our way across two roped traverses – one named “the belly roll,” and another named “the crawl.” With the wind now whipping wildly, it had gotten cold and the slow going only made it worse. Even still, we made it across, and then worked our along another roped route, this time a vertical chimney.

You have to push a button and they’ll open the door for you. This will bring you to a plaza that looks like this:

You have to push a button and they’ll open the door for you. This will bring you to a plaza that looks like this: Upon entering the plaza, turn immediately to your right and knock on a door. A man attended to us and charged 2 Euro each for an entrance fee to the cemetery. He then directed us to the Blue Gate on the left hand side of the chapel, through which we entered a long park.

Upon entering the plaza, turn immediately to your right and knock on a door. A man attended to us and charged 2 Euro each for an entrance fee to the cemetery. He then directed us to the Blue Gate on the left hand side of the chapel, through which we entered a long park.

The first key to taking advantage of loyalty programs is, of course, to understand them. It’s not nearly as intimidating as you’d think. To begin, know that there are essentially three forms of travel rewards you can accrue:

The first key to taking advantage of loyalty programs is, of course, to understand them. It’s not nearly as intimidating as you’d think. To begin, know that there are essentially three forms of travel rewards you can accrue: You don’t need to go out and sign up for a bunch of credit cards right away, but there is no harm in enrolling in the loyalty programs for airlines and hotels.

You don’t need to go out and sign up for a bunch of credit cards right away, but there is no harm in enrolling in the loyalty programs for airlines and hotels.

All this is for naught if you can’t figure out how to use these points you’ve been gathering. There’s always the good old fashioned way of calling in, but unless your a pro at interpreting broken English and waiting on hold excites you, you’re going to want to book online.

All this is for naught if you can’t figure out how to use these points you’ve been gathering. There’s always the good old fashioned way of calling in, but unless your a pro at interpreting broken English and waiting on hold excites you, you’re going to want to book online.