The fact is, we want you traveling. There’s nothing we’d love more than a guest post a week from one of you, telling us how you’ve unlocked the world by taking advantage of frequent flyer mile deals. If there’s ever any way we can make it clearer or easier for you, we hope you’ll ask.

In that spirit, I going to tell you which of the currently available offers is best right now.

“Best” is always a subjective term. The reality is, depending on exactly what you’re after, one card could be much better than another. For example, if Frontier doesn’t fly out of your city, maybe even a great offer on that card wouldn’t be any good for you. But I know how people tend to like to have it boiled down and easy. So, here’s my attempt at laying out the “best” available cards at the moment.

Best Airline Card

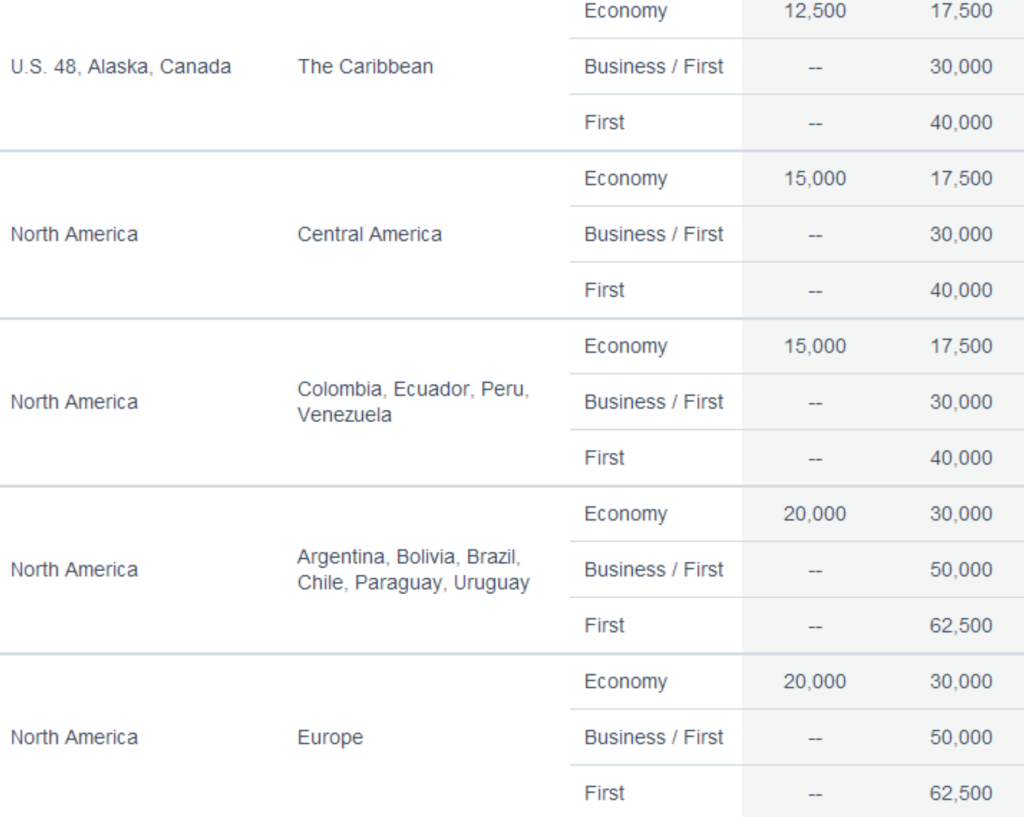

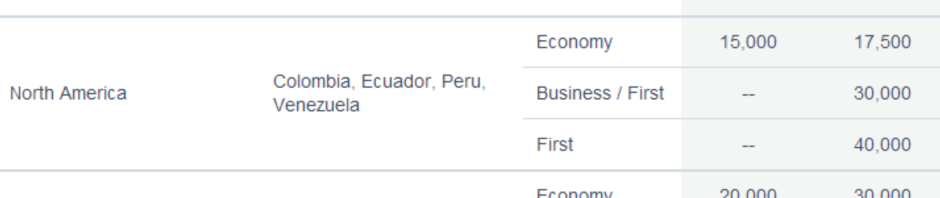

There are two problems in the airline mile world right now – they want too dang many miles for award ticket redemptions, and they have hardly any availability at the lowest levels. Especially since integrating with US Airways, I’m finding that American Airlines has both the lowest redemption levels, and the most availability at the low levels. AA is what took me to Italy last year, it’s what took WorldWanderlusting friends to Dublin right now, and it’s what will take me to Peru and Hawaii later this year – all at the lowest redemption levels and with a fair amount of availability.

Wouldn’t it be really nice, then, if some of the best offers out there were for cards that offer AAdvantage miles? Well, we’re in luck.

Some serious value in American’s Award Chart

We always advocate using credit cards only to make purchases you would otherwise make with cash, check, or debit, so sometimes higher minimum spending requirements aren’t practical for everyone. If, however, you’re in a position to spend $10k in the next 3 months on a card, you’re going to want to pick up the Citi Executive AAdvantage World Mastercard. Why? To start with, it’s because of the massive 100k point bonus after meeting that spending requirement. It does charge an annual fee – a big one – $450, but the offer also includes $200 cash back, along with Admirals Club Membership.

If that spending requirement is too steep, try on the Citi AAdvantage Platinum Select card with a 50k bonus after spending $3k in the first 3 months. Get one for your spouse, too, after the first 3 months and 6 months of spending $1000/mo on credit cards will net you over 105k AA miles – that’s more than 2.5 trips to Europe, 3.5 trips to South America, or 3 trips to Hawaii.

Best Hotel Card

Staying one night in a hotel is always a bit of a bummer – you have to pack up as soon as you wake up, and who wants to do that? At the same time, staying at the same place is a little tedious after a while. I find that the sweet spot on a touring trip is 2 nights. How cool would it be if you could book one free night, then get a second free night, free?

We mapped out this tour using CC hotels all around England.

Well, you can. It’s as simple as having the US Bank Club Carlson Premier Visa. With this card, in addition to Gold Status (Hello Upgrade!), whenever you use your Gold Points to book a Country Inn and Suites, Park Inn, or Radisson hotel through their program, your last night is free.

So what would really be nice is if it would come with some points to get you started taking advantage of that sweet deal. Hmm… well, how d0es 85k sound after spending $2500 in the first 3 months sound? They will ding you for the $75 annual fee up front but who’s gonna cry about that when your 85k will get you 5+5 nights in a category 2 hotels in Great Britain, Florida, or South Carolina?

Best Bank Points Card

I see Bank Points as a way to “connect the dots” between free flights and free hotels. As such, there are programs that are great for making transfers to other loyalty plans, and programs that offer cash reimbursement. Both of these have their place, too. Sometimes you just need a few more points to top off a frequent flyer mile account – maybe bumping a United balance from 55k up to 60k. For that kind of thing, the Chase Ultimate Rewards Program is great, but if we’re talking about a day-in and day-out usage card that you can really rock on and get some miles built up, I’m going to steer you in the direction of the Barclaycard Arrival Plus™ World Elite MasterCard®.

For starters, the way to use this card is far easier than any other program – no calculating the value of various flights only to find that they’re unavailable – no limitation to specific hotels in lower categories. It is plain and simple – this card allows you to use points to reimburse your travel expenses. That in and of itself is great, but it gets better – you accumulate those points at a total rate of 2.2% cash back for travel.

Brad and Nicole aboard the Norwegian Spirit

If you’ve got your flights and your hotels covered, but you’re trying to make your almost-free vacation almost freeer, get a ride on the Barclaycard Arrival. Just put that car rental expense on it and reimburse yourself with some of the 40k points (equivalent to $400) you’ll get after spending $3k in the first 3 months. No disappointment on an up-front annual fee on this one.

If you’re thinking “free flights are great and all, but what I’d like is a free cruise,” welcome the Barclaycard arrival to port.

If you’re the kind that likes hotel rooms and all, but what you’d prefer is a quaint agriturismo, a bed and breakfast, or a room in a castle, enter the Barclaycard Arrival.

—

Maybe this will make it a little easier on you. We just hope you’re planning some great vacations for this summer and beyond.

Thanks for wanderlusting with us.

I don’t see a link for the Citi AAdvantage Platinum Select card with a 50k bonus after spending $3k in the first 3 months, and I can’rt find it on their website. Is this offer still valid? Thanks!

Katy- Try this link to find the card we were talking about. You can find most of our cards on the Best Travel Credit Cards Page.