If you’ve been contemplating getting a travel rewards card for your business, Chase just made the offer a little sweeter on their Ink Bold Charge Card and Ink Plus Credit Card. Historically they’ve offered 50k Ultimate Rewards once you meet the $5k spending requirement within the first three months, but for now they’ve bumped that offer to 60k -likely for only a limited time.

These are both cards that I’ve gotten long ago, and sadly Chase won’t award more than one bonus for each card, so I’ve had my fun with these ones, but that doesn’t stop me from telling you about them. (That said, when I got each of these cards, they were Mastercards, but now they are promoted as Visas – there’s a chance I could re-up, and with this offer, I may just do that).

Probably a limited time offer

To begin with, the difference between the two is simple. The Ink Bold is a charge card, which means the balance must be paid in full every month. The Ink Plus is a credit card, which means you could make a minimum payment and actually use the card as credit. Where our policy in managing cards is never to use them as credit, but only as a purchasing instrument for things you would otherwise only buy with cash, check or debit, that means they are essentially the same thing.

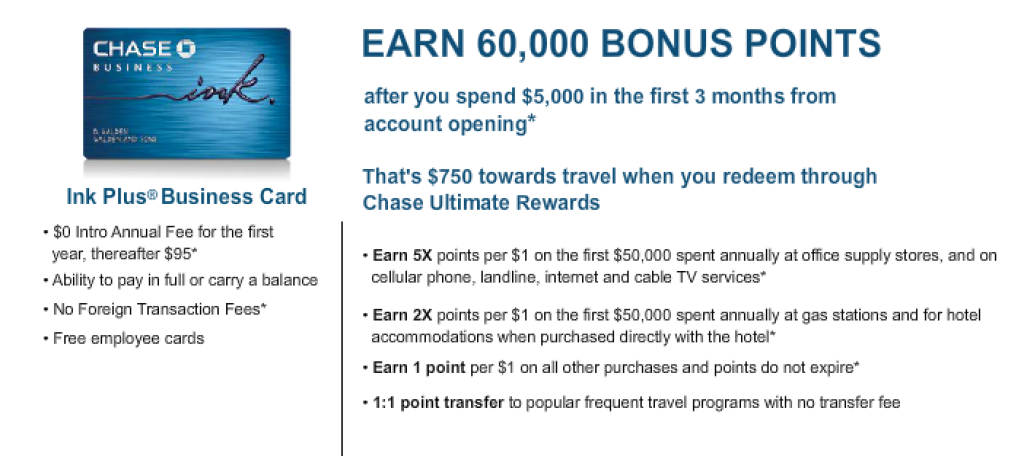

Both cards do have an annual fee of $95, but it is waived the first year. Neither carries any foreign transaction fees, and in both cases, for now, the bonus is 60k Ultimate Rewards points after spending $5k in the first 3 months.

This is a generous bonus on a pair of cards that are extremely useful, particularly for business owners who have a lot of office and fuel expenses. This is because the cards offer 5x points for every dollar spent at office supply stores and on cable, internet, and phone. They also offers 2x point for every dollar spent at fuel stations. Putting all of your business expenses on either card could be a very points-lucrative proposition.

But let’s start by just looking at the bonus. By the time you spend your first $5k on the card, some of your purchases will likely have been in the multiplier categories and let’s just say you had accumulated 8k Ultimate Rewards – then your 60k bonus hits and it’s time to start thinking travel.

These Ultimate Rewards Points are very handy because they are so flexible. Where loyalty points are divided into Airline miles Hotel points, and Bank points, these are bank points that can spent like cash, or transferred to a number of different programs.

Just to illustrate, I’ll offer some ideas as to how you might be able to put these points to good use.

- Transfer to British Airways for some great deals on short-hop flights on partner airlines like American, Alaska Air, or LAN – I love this idea and we’ve posted about some of the best ways to use British Airways Avios – 9k RT from SLC to LAX means these 68k points could get 7.5 people on a flight like that. LAN is great for flights from Lima to Iquitos (for my Manventure), or Lima to Cuzco. WorldWanderlusters Doug and Aly used BA Avios to fly from London to Dublin, too – another great use.

My wife and 4 friends flew RT to LA with 50k BA Avios

- Move the points to Southwest Rapid Rewards to use in conjunction with your Companion Pass – This is what I’m doing! We’ll be getting 2/6 of us to Florida with my SW companion pass.

- Plan a Rail Vacation on Amtrak – Redeeming points to book Amtrak tickets is also relatively simple. They’ve divided their route map into 3 distinct zones. Stay within a single zone and your one-way coach ticket is 5,500 points (4,000 if you stay within the northeastern sub-zone from Virginia Beach to Montreal). If your trip will take you into a second zone, you’ll be looking at 8,000 points and a third elevates the cost to 10,500. You could use very few of these points to arrange for quite the traincation.

- Transfer points to IHG, then take advantage of Pointbreaks – Every quarter IHG offers up hotel rooms in specific places for a mere 5k points a night. Your 65k UR points could get you 13 nights in any of these hotels.

- Spend the points like cash on Chase’s UR Travel Portal – Forget about having to worry about the point systems and simply use the points as cash at a rate of 1:1.25 – your 68k points will net you more than $900 towards flights or hotels through their online system.

These are just a few ideas, but the possibilities are endless. There are so many places these points could take you – especially if you have some ongoing business expenses that will help you keep your UR account flush with points.

Here are just a few more things to consider:

- These points do disappear if you cancel your card before transferring or spending them – keep that in mind before you decide to call in and cancel.

- You could also just get pure cash back with your points, though the value isn’t as great that way.

- Sheldon and I don’t get any commissions on this card (or hardly any others any more), but we’re still promoting it as always because the opportunity for you is abundant.

- If you’re reading this and wishing you had a business so you could apply, read this post from Million Mile Secrets on ways you may qualify to have a business credit card – it’s less than you might think.

We appreciate you wanderlusting with us and we’d urge you to go Like our Facebook Page if “almost-free travel” is something that appeals to you.