It had been too long. I woke up on Saturday morning and without really thinking about it and applied for 3 credit cards in one day. The reaping was fruitful with a 3/3 success rate! I’m so excited about these three cards let me show you which cards I got.

1. Barclaycard Arrival Plus™ World Elite MasterCard®

We’ve posted numerous times about this card. They recently upped the spending requirement on it, but the card is awesome. Here are some of the noteworthy reasons to get this card:

-Enjoy 40,000 bonus miles after you spend $3,000 on purchases in the first 90 days — that’s enough to redeem for a $400 travel statement credit toward an eligible travel purchase.

– Earn 2X miles on all purchases

– Get 5% miles back to use toward your next redemption, every time you redeem

– Miles don’t expire as long as your account is open, active and in good standing

– No foreign transaction fees on purchases made while traveling abroad

– 0% introductory APR for 12 months on Balance Transfers made within 45 days of account opening. After that, a variable APR will apply, 16.99%, 20.99% or 23.99%, based on your creditworthiness. There is a fee for balance transfers.

For other posts about this card read:

2. Citi Executive AAdvantage World Mastercard

We’ve posted about this card before. It never really interested me in the past because the bonus was a boring 30K American AAdvantage miles. That isn’t anything to get excited about, especially when it comes with a $450 annual fee (not waived).

However, the new offer that came around was for 100k AAdvantage miles, plus they gave you a dollar-for-dollar credit for your first $200 in expenses, which essentially made the annual fee $250. That is much more palatable, espeically when you consider it gives me 100k miles and lounge access to all American Airlines and US Airways airport lounges. Basically for $250 you’re getting 2.5 off peak trips to Europe. Yeah that’s a steal if you can’t read between the lines.

The big problem here is the spending requirement. Unless you have a business that spends tons of money, or you’re super rico (of which I’m neither) this card is extremely difficult to meet the spending requirement. Fortunately I’ve got a friend who spends a ton on a credit card each month for his business and he helps me out from time to time when I need to meet big spending requirements.

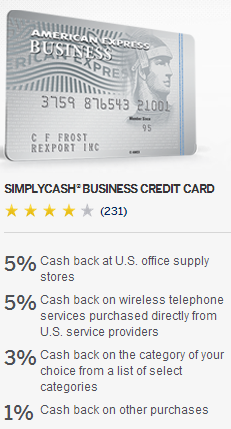

3. American Express SimplyCash Business Credit Card

Link: American Express SimplyCash Business Credit Card

I got this card back when they offered an initial bonus of $250. The card has some strengths that really made me like it:

- No annual fee

- $250 Bonus (expired)

- 5% Cash back at U.S. office supply stores

- 5% Cash back on wireless telephone services purchased directly from U.S. service providers

- 3% Cash back on the category of your choice from a list of select categories- Restaurants/Gas Stations/etc

- 1% Cash back on all other purchases

Basically I saw this $250 bonus wiping out the $250 annual fee on the Citi Executive Card. If you look at it that way I ended up with:

- 100,000 AAdvantage Miles

- Airport Lounge Access for a year

- 40,000 Arrival points ($400)

Not bad for a 3 card run. It loads up my AAdvantage account in anticipation of future trips that are yet to be planned, but surely to be taken. If you were to get three cards today which cards would they be?

So if I already have a Citi AAdvantage card (Platinum Select- applied in July 2013) am I eligible for the bonus on this card? I have seen conflicting reports on various sites…just wondering what your opinion/experience has been?

Sorry for the slow response. I was out the last week on a trip to sunny Florida!

I will let you know how my experience is with scoring the 100k miles. I picked up the Platinum Select about a year ago and just met the spending requirement. When the miles roll in I’ll let you know.