The Barclaycard Arrival World MasterCard – $89 Annual Fee Card is a “must-get” free travel credit card with the annual fee waived the first year. Disclosure: Brad and I do earn a commission when you apply for this card through our link. It’s also the best version of the offer that’s out there.

Here are the top 10 reasons, plus 3 more, to ensure the Barclaycard Arrival is part of your next App-O-Rama, or at least one you get soon.

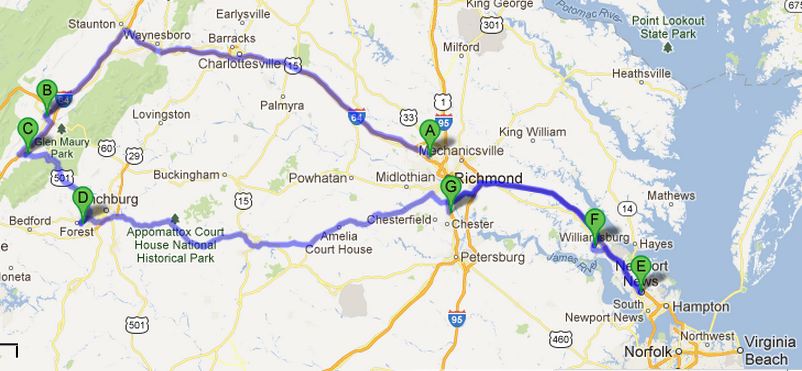

1. $400 for Free- Your mother always taught you that nothing in this world is free. I’m here to tell you that she’s right. You have to pay by way of a 2-10 point drop in your credit score that won’t last more than a couple of months for most people with excellent credit. Seriously, this card offers you at least $400 in travel on any of these categories: Airlines, Travel Agencies & Tour Operators, Hotels, Motels & Resorts, Cruise Lines, Passenger Railways and Car Rental Agencies.

2. 2 Points per Dollar on All Expenses- Capital One acts like they’re the only ones who give this benefit. Wrong. The Barclaycard Arrival also offers a valuable 2 points per dollar on all expenses. That way you can rack up 2% in travel reimbursement.

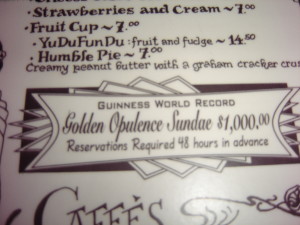

3. 10% of Your Miles Back in Your Pocket – When you redeem your points for the travel expense of your choice they automatically refund you 10% of the points used. So let’s say you booked a Cruise leaving San Juan, Puerto Rico to the Southern Caribbean and it was a $379 Cruise with taxes and all. Upon redemption of the 37,500 miles from the Arrival card you’ll need, they’ll drop 3,750 back in your account. This means that the $400 that they give you really equates to $440. Gotta love getting more and more in a world where it feels like everyone is giving less and less.

3. 10% of Your Miles Back in Your Pocket – When you redeem your points for the travel expense of your choice they automatically refund you 10% of the points used. So let’s say you booked a Cruise leaving San Juan, Puerto Rico to the Southern Caribbean and it was a $379 Cruise with taxes and all. Upon redemption of the 37,500 miles from the Arrival card you’ll need, they’ll drop 3,750 back in your account. This means that the $400 that they give you really equates to $440. Gotta love getting more and more in a world where it feels like everyone is giving less and less.

4. No Foreign Transaction Fees – With an upcoming trip to Canada this is something that is fresh in my mind. Aye. It is always nice to have a card in your arsenal that waives these buggers. Although I’m embarrassed to admit it, last time I went to Canada I forgot one of these and had to pay 3% on top of everything as a result.

5. Easy Spending Requirement– These days getting a card that has a $3000 spending requirement is getting tougher and tougher. This one is really easy to meet. Make sure that you’re spending all of your creditcardable (I made up this word) expenses. If you need help, reference our post about how to meet a spending requirement.

6. Transunion Credit Pull– Most of the credit cards issued by American Express, Citi, and Chase are going to pull from either Experian or Equifax. The whole idea behind using your credit cards to load up points and miles is that it affects your credit the least amount possible. Time and time again we’ve told you to carefully monitor your credit and to diversify the pulls among all three bureaus. Just FYI: you’ve got three credit scores that are from TransUnion, Equifax, and Experian. One of the components of your credit score is credit inquiries. When you apply for a credit card, and they pull your credit from Experian, the other two bureaus don’t show that as an inquiry. Thus you spread the inquiries out and it helps you to keep your score high.

7. Barclaycard historically has allowed you to apply for more than one of their cards in a day. – This is great when you’re planning a fatty App-O-Rama Churn like the one that I did in February that netted me 285,000 points and miles. Whew! Brad was successful in getting the Frontier Airlines card as well as the US Airways card, both of which are issued by Barclaycard. This is great because sometimes they’ll combine both inquiries into one (Though there is no promise of this).

8. This is a Mastercard – You’ve already got about 10 Visa credit cards. None of them work at Sam’s Club for some stupid reason. Discover isn’t giving the most generous bonuses these days, so getting this card will allow you to make your Sam’s Club purchases and earn points and miles for them.

9. No Blackout Dates – The Barclaycard Arrival World MasterCard – $89 Annual Fee Card is really good for flying or hotels when there are no other point redemption options. Let’s say you want to leave on a Friday and come back on a Sunday for your next vacation because your boss is stingy with time off. This card will be more valuable to that guy because his points actually help him book his vacations instead of sit in his account because of the lack of availability.

10. You can use this card for a cruise – I just was chatting with a friend who wants to cruise the Southern Caribbean this winter (who doesn’t?). I told him that this card could be used for his cruise and he didn’t believe me. It would be sweet to use this puppy for the cruise and use some miles for the flight, which would equate to a really amazing vacation in February when all your friends are broke because of Obamacare and you don’t have any money either, but at least this card paid for your cruise, right?

11. Complimentary TripIt© Pro – They normally want you to cough up $49 per year for this service, but it comes with the Barclaycard Arrival. They have some really cool features like: Alerts about your flights, tracking for all your points, flight refunds when they are available (psssshhhhh yeah right. When monkeys fly out of my butt), and some car rental privileges as well.

11. Complimentary TripIt© Pro – They normally want you to cough up $49 per year for this service, but it comes with the Barclaycard Arrival. They have some really cool features like: Alerts about your flights, tracking for all your points, flight refunds when they are available (psssshhhhh yeah right. When monkeys fly out of my butt), and some car rental privileges as well.

12. Because you probably have already scored all of the Chase Cards – Because Barclaycard is really stepping up their game, all of the sudden the field is much bigger. This is a way to expand your portfolio with points that are super useful in your Award Wallet. Make sure they become a part of it.

13. Because you want to WorldWanderlust – Keeping this blog has been a lot of fun for Brad and me. We have really enjoyed seeing others take on traveling as a passion, whereas otherwise it would be impossible for them. Many friends have taken amazing vacations and you should too. Don’t tell yourself that travel is out of your league. You’ll never regret the experiences you have in this life.