Disclosure: Brad and I earn a commission if you use our link to apply for the The Choice Privileges Visa Card. We would appreciate your applications!

Link: The Choice Privileges® Visa® Card

Barclaycard continues to offer cards that are more and more competitive in the market. This card is the The Choice Privileges Visa Card, and they’ve got an valuable proposition for you right now.

Hotels in the Choice Privilege Family

These properties aren’t going to compare with those of the Starwood Preferred Guest program, but many of them offer free Internet, breakfast, and are clean. These are probably the three most valuable features to me when it comes to booking a hotel.

- Comfort Inn

- Comfort Suites

- Quality Inn

- Sleep Inn

- Clarion

- Econolodge

- Rodeway Inn

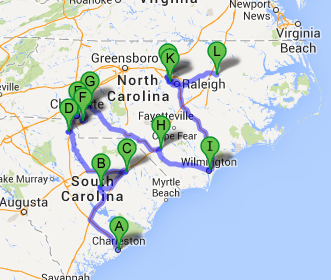

Where can I find Choice Privilege Hotels?

They’ve got loads of hotels in the US and Canada, but still quite a few in Europe too.

| Choice Hotels By Region | Properties | Top Destinations |

| U.S. | 5,116 | New York, Orlando |

| Canada | 301 | Montreal, Toronto |

| Caribbean/Mexico | 29 | Bahamas, Los Cabos |

| Central/South America | 70 | San Jose, Sao Paulo |

| Europe | 417 | London, Paris, Rome |

| Asia and Pacific | 355 | Sydney, Tokyo |

Redemption of Choice Privilege

The hotel redemption varies by property.

- Tier 1- 6000 Points

- Tier 2- 8000 Points

- Tier 3,4,5 on up to 35,000

They have over 1500 hotels across the globe in these first two categories. This is very generous of them. If you want to search these hotels, check out this list of hotels in their two lowest categories.

These guys really shine using lower categories in bigger cities. For example: they have low category hotels in towns like London, Edinburgh, Venice, Berlin, Frankfurt, Munich, Paris, and more. This is VERY valuable if you’ve ever tried redeeming points in cities like these.

You also have some advantages if you’re trying to travel through rural areas like Wyoming, North Dakota, and South Dakota. Coming across a SPG property is much more rare in areas like these.

When do the Choice Privileges Points Expire?

Award nights are fully transferable to immediate family members (spouse, partner, children, parents, in-laws, brothers and sisters). Points expire on Dec. 31, two years after the year in which they were earned.

The ability to transfer them is great, but the redemption is a bit of a bummer. For the points to not be able to roll forward from year to year with a new activity is a bummer. If you’re looking to use them in the next two years, this is totally fine.

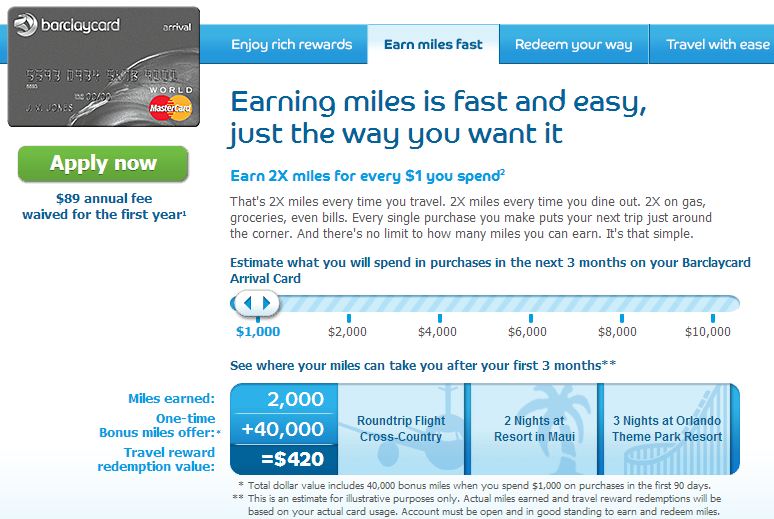

What is the current offer for the The Choice Privileges® Visa® Card?

This offer is a Limited-Time Offer, and has some real value. By staying and paying for one night at a Choice Hotel you’ll end up with 32,000 Choice Privilege Points, which can amount up to 4 nights at hotels in very valuable places like Paris, London, or Venice. You should really consider getting this card if you’ve got to stay in a Choice Hotel in the next little bit anyway. Then plan your dream trip.

What other benefits come from the Choice Privileges Visa Card?

- No Annual Fee

- Ability to book hotels 50 days in advance of stay instead of 30

There’s obviously no way I could possibly fly 100 segments in the first month of the year, and earning 110,000 Rapid Rewards from flights only is also not an option.

There’s obviously no way I could possibly fly 100 segments in the first month of the year, and earning 110,000 Rapid Rewards from flights only is also not an option.

We’ve blogged pretty extensively about the Niagara Falls area – and it has a romance all its own. We have a couple of specific posts that go over some of the details on this:

We’ve blogged pretty extensively about the Niagara Falls area – and it has a romance all its own. We have a couple of specific posts that go over some of the details on this: