Notice: Sheldon and I run this blog as a hobby – a really fun one that allows us to show other people how we’re able to use our credit prudently to get frequent flyer miles and points to travel like kings on a pauper’s budget. We do make a little money at it because some of the cards we’re promoting pay us a commission when readers apply using our links and are approved. The card we mention in this post is one of them, but we promote it because of the great travel benefits, not just for our own self-interest. Most of the money we make is turned right around into trying to grow our readership. We hope you’ll share our blog with your friends.

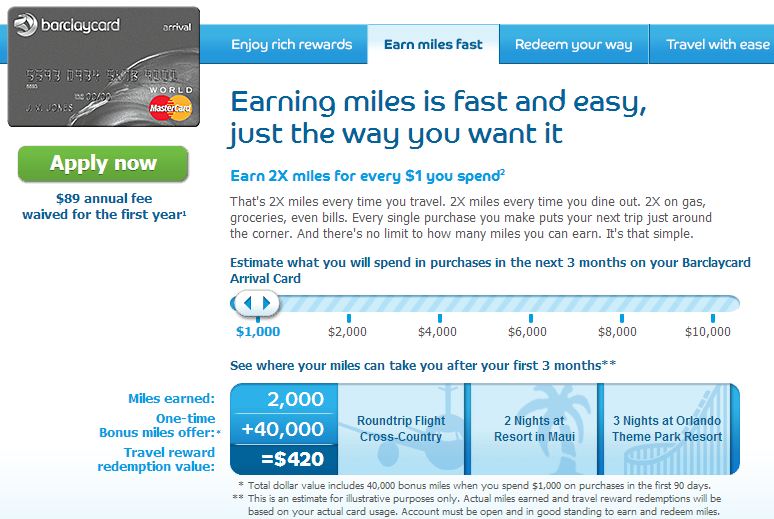

I have turned the Barclaycard Arrival World MasterCard into my “rack up some serious spending” card. For my business, I often wind up with considerable “credit card-able” expenses. With its reward program which offers 2 points for every dollar and 10% in points back after redemption, the way I see it, I get 2.22% cash back for travel on every expense I put on the card. Considering that the issuer probably only makes 3%, I’m recapturing a significant percentage of what vendors have to pay to accept my card in the first place.

Even if I didn’t have the business expenses, my wife and I have calculated that we have about $1500/month in costs that we can use a credit card to pay. (Here’s a post about what expenses you can pay with a credit card). At that rate, I’m accumulating $30/month in free travel in addition to the $420 I start with the 40k bonus after meeting the $3000 spending requirement.

In any case, with all Barclaycard Arrival Points I’ve been piling up, I’m starting to feel pretty flush. With our Italy trip coming soon, we had to pin down a babysitter, and with four rambunctious kids, our options were limited to paying someone. I thought… what would be really nice would be to pay our babysitter with points!

But I came here because you said I could cruise for free

I know. I’m sorry, I’m getting there. Nicole’s sister has heard us rave about cruises and seen us travel all over the world on points. She’s great with our kids and it seemed like the perfect nexus. I pitched her on the idea of us paying her for watching our kids by booking her and her husband a cruise.

Enchantment of the Seas – Photo from www.luchaniktravels.wordpress.com

My favorite cruise-booking site is www.vacationstogo.com. I’m especially fond of the 90 day ticker which lists some seriously discounted cruises. It just so happened that their window for time off to vacation was limited to the first week of January. It also just so happened that there was an amazing deal on the Royal Caribbean Enchantment of the Seas – $149 before taxes for an interior cabin for a four night cruise. PLUS a $50 on-board credit! (In case you’re worried that a $149 cruise might not be all that great, read these great posts about this ship [Photo Review and Midnight Buffet] by www.luchaniktravels.wordpress.com).

I tend not to hesitate when I see incredible deals like that, so I booked it – paying with my Barclaycard Arrival World MasterCard. The total, including taxes, was $441. Now, reimbursing myself will be incredibly simple. When the charge appears on my account, I’ll see it by logging into the Barclaycard site. I’ll click on the charge and redeem 44,000 points… then I’ll smile really wide when I see it instantly reimbursed in my account.

How the Barclaycard Arrival World Mastercard works

It really is that simple. I always marvel at the value presented by cruises – I mean, to think that you can have lodging (small, but well-serviced), food (incredible and unlimited), entertainment (hokey at times, but very well-done), and transportation to islands in the Bahamas for $55/day? Now, heap upon that the fact that with the reward points from my Barclaycard I can get it for free? I know it sounds like a fantasy… but this is for real… Tiffany and her husband are already planning their cruise in the Bahamas.

Here’s where it gets really crazy cool. With the 10% back on reward points, I’ll get 4,400 right back in my account… already piling up for our next adventure (or the next babysitter bribe we have to pay).

Well, cool! But, what about the every 13 months thing?

Even if I didn’t have any business expenses, just using this card for every day expenses at $1500/month and starting with the 4,400 points, I could be right back to where we could do this again after 13 more months (13×3,000=39,000+4,400). Now, you’ll see that this card does have an annual fee, though it’s waived for the first year. You’d need to determine whether it’s worth it for you to do this twice (once for you and once for your spouse), or to keep the card and re-up every year. I always recommend calling to renegotiate on the annual fees, too – you never know what they might give you.

What I’m getting at is that whether your wanderlust is for cheap cruises, Allegiant Airlines getaways, or whatever else you’re imagining, using the Barclaycard Arrival World MasterCard is a brilliant way to help yourself make these things happen sooner and more often.

Have a question? Check our FAQ or leave a comment below.