So, one year later after my first credit card and my score has risen 26 points!!!! I started a year ago and had an 800 credit score at the time. I was pleasantly surprised to see that the score had risen over the last year by 26 points.

Some people tell me that I should be proud of my 826 score. Obviously it is great that I have good credit, but it isn’t amazing because the score doesn’t really help me much as long as it is over 720. I still want to keep it high to show that I am worthy of having credit, but not so worried that I keep it above a 826.

CreditSesame.com is the product that I use to get my Experian credit score reported to me on a monthly basis. It is a free service and they have worked great ever since I initially signed up with them.

Before you get too excited and apply for a million cards we wish to caution you and remind you that your credit is very important. It is never worth one sign on bonus if you are going to be missing your payments or you are going to be carrying balances on 20% interest rates. You’ll notice that we always talk about paying off the credit card in full every month. This is crucial to making sure that you never pay anything for these huge sign on bonuses.

I’m coming up on my first year with the American Airlines Citi Visa credit card. It has treated me well and scored me a lot of points. I’ve racked up over 80,000 AAdvantage miles on that card. Here in the next week or so I will be canceling this card. I will be sure to ask for some type of a retention bonus, or ask them to waive the annual fee like we mentioned in our post the other day.

So far this year has been a great success. Let me recap my earnings:

- Citi Visa: 75,000 AAdvantage miles as a bonus, plus over 5000 in charges.

- Citi Business Visa: 75,000 AAdvantage miles as a bonus, plus over 5000 in charges.

- Capital One Venture Match your Miles Promotion: Bonus: 110,000 Points= $1100 in spending whether on airfare, hotel, car rental, etc.

- SPG Amex: 10,000 bonus for first purchase, plus 20,000 after spending a hefty $15,000.

- SPG TD Ameritrade Deal: 20,000 Star points

- Citi Visa (Wife): 75,000 AAdvantage Miles plus over $5000 in charges.

- Capital One Venture Match your Miles Promotion (Wife): Bonus: 110,000 Points= $1100 in spending whether on airfare, hotel, car rental, etc.

- SPG Amex: 10,000 bonus for first purchase, plus 20,000 after spending $4500

Grand Totals:

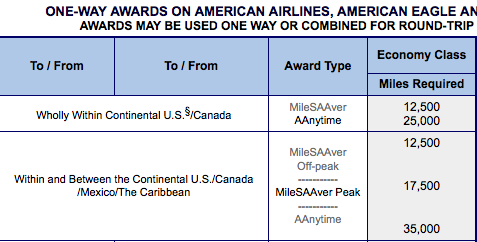

- 240,000 American Airlines AAdvantage Miles

- $2200 in Travel Expenses

- 100,000 Starpoints

I’d call that a great success. All the while my credit score increased 26 points over the same course of time. My wife’s has stayed the same over the last year.

The end result is that you can score some amazing deals as long as you are patient, and you are disciplined enough to pay them off at the end of the month. Make sure that you never charge anything on the card that you wouldn’t pay in cash. I may joke about it with the cashier at the store, but it isn’t free money. It can be very expensive money if you are not careful.

On a side note…..We love having all of the questions and comments. We will do our best to answer your questions if possible. Make sure you like us on Facebook and share it with your friends. We have also updated the Frequent Flier Miles Credit Cards page on the site. Let us know if you see any other great deals too.