Sometimes choosing the best of anything can be difficult. When people often ask about my favorite place I’ve ever visited, or my favorite trip, and I avoid the question by explaining that I have a favorite beach, waterfall, culinary trip, or something else. Other times choosing the best is easy. When someone asks my which Airline credit card is the BEST, I can answer with confidence it is the Citi Platinum Select AAdvantage. This card is a beautiful thing, check out why I feel this way.

This is it. Check it out!

Best Airline Credit Card Benefits

This card comes with a few incredible benefits that I love. Let me know what you think of these bennies.

$95 Annual fee is waived the first year

Yes. Paying annual fees is a bummer, and waters down the value of the card. Plus these guys usually will waive the annual fee when you call up at the end of the year.

50,000 Bonus AAdvantage miles

Check out their award chart. You’ll quickly see that their program has some sweet spots when traveling to Central America or to Europe in the offseason. These awards are much lower than their competitors. This is one of the many reasons that makes this card the BEST airine award credit card.

American Airlines Award Availability

If you’ve ever tried booking an award ticket with US Airways, or Delta, you already know that points can be dang near worthless. Not the case here with American. American has some of the best availability to use the miles, which means that you actually get to use the miles. Sweet!

Photo courtesy of Tnooz.com

Free checked bags

Checking bags these days can get expensive! Seriously they want $50 for a round trip bag, yuck! This card offers a free checked bag for up to four total people on your itinerary. This should be enough for most families, even if they have more people. You should just carry-on a few smaller bags to make up the difference.

10% of Your Redeemed Miles Come Back to You

I had read about this benefit, but hadn’t even paid attention to how it actually works until last week. It was the reason that inspired me to write this post! I recently booked a trip to Europe for the wife and I, which is going to be awesome! The normal guy booking my exact same trip would have paid 80,000 miles for booking this trip, but not me!

I used the 80,000 miles to book the trip, but having this card allowed 8000 miles to back into my account, only really costing me 72,000 miles. Sweet! They say this benefit may take up to two months, but it happened almost instantaneously for me. When booking a big trip it really is worth making sure this card is still in your arsenal.

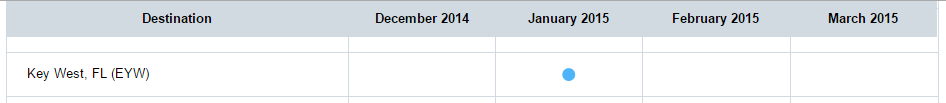

Citi AA Reduced Mileage Awards

This benefit is another way to stretch the 50,000 miles, and it’s easy peazzy lemon squeezie to book. First you check out what destinations are on the list. Then you choose one of these places that you’ve always wanted to visit Jackson Hole for some fresh powder skiing. Find the location:

Then you cruise to the AA website to find the SAAver Award for the dates that work, pray for tons of powder to fall from Heaven, then call the AAdvantage Award desk to book the flight. You might even get a customer service rep who helps you find the dates.

This can save you 7,500 AAdvantage miles round trip! That drops your price from 25,000 miles to 17,500 for a roundtrip ticket within the USA. You can’t even get that with Southwest most times!

They even have some warm weather destinations for those who are sick of the cold.

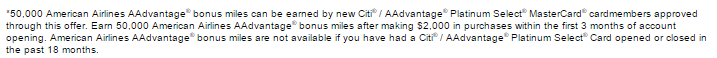

You can get this bonus every 18 months

Per the terms and conditions:

I haven’t tried lately, but this hasn’t been a big deal in the past with an opened account. They’ve usually allowed me to get this bonus again and again. Hopefully they don’t clamp down on this anytime soon. Make sure you have the card open when you need to book the trip so you can get the 10% of your miles back in your pocket again.

Do you think this is the BEST Airline Award Credit Card?

What are your thoughts? Do you agree that this is the best airline award credit card? What features do you like about this card most? If you have another card that you like more, what do you like about that airline card?

I’m so glad I have this card! 🙂 and that you have introduced me to more ways to make the most of it!

I am seeking advice now: since you can re-sign up for this card after 18 months of closing to get the 50,000 bonus, is that what you, personally, do?

My year mark is coming up in March, so would you recommend cancelling before they charge the fee, wait 18 months, then sign up for the card again?

I hope that makes sense.

Thanks!

-Annika

Annika- I have had a variety of these cards over the years. The one that I currently have has been in my card stash for almost two years now. Last year they offered to waive my annual fee, so I decided to keep it. I called again last week and they offered to waive it AGAIN. It has good enough benefits, and there are enough cards out there that I decided to keep the card another year.

You’ll just have to decide what works for your upcoming needs. Right now I have quite a few AA miles, and my wife is up to get the card soon. I always want to have a good relationship with the banks, so I try to keep them as happy as possible. If they want to waive the annual fee for a third year, I guess I’m cool with that.

Thanks for wanderlusting with us!

Thanks for the reply! Do you say anything specific to them to get them to waive the annual fee? Do you recommend live chat, or a phone call with a live person?

I always call. Add a little charm to the worker there. Treat them like gold! That’s easy to do over the phone!