Over the years this question has plagued many of our readers. Many people wonder whether or not their stay at home spouse can apply for a credit card separately. The short answer is yes, but continue reading to better understand why.

Credit is Individual

Whether you’re married or not, you both have your own credit scores. This is important to know when greedily seeking credit card sign up bonuses for your non-working spouse. Both of you need to have credit, and it should be excellent credit.

If your stay at home spouse doesn’t have good credit, you could consider adding him/her to one of your cards as an authorized user. This will help strengthen their score and give them stability.

Isn’t Being an Authorized User Just as Good?

Heavens no. Being an authorized user won’t result in 40,000 additional Ultimate Rewards, or 50,000 AAdvantage Miles. When you’re really cranking out Frequent Flyer Miles you both need to pick up the Sapphire Preferred which gives you 40k and her 40k, which means now you’ve got 80k miles.

Getting a card for each of you will load your Award Wallet with more miles, which means more vacations, and more smiles. Life is good when you’re on the road visiting new places. Our strategies will help you to take more vacations more often than your neighbors and friends, which will make them jealous. The good thing is that you can share this blog with them to help them visit more places for less.

What about the Income Question?

When was the last time you know someone who got divorced and the non-working spouse got nothing from the divorce? Try never.

Living in Idaho, which is a community property state, means that everything that is mine, is my wife’s. Whether she earned it, or I did, the court doesn’t care and it belongs to both of us. That’s reason alone for me to put our household income on the application.

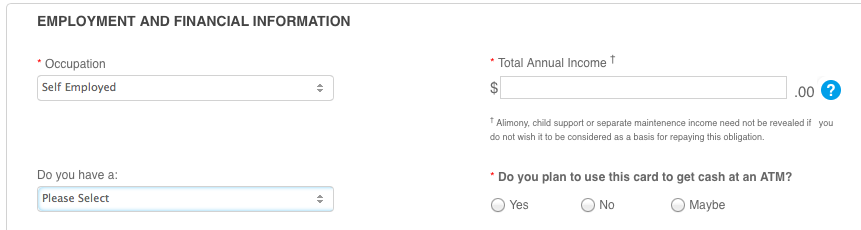

On April 29th of 2013, the Consumer Financial Protection Bureau made an amendment that allows for stay-at-home spouses to use household income on the application as long as they have access to the money, and a few other criterion. This is great news for all people who have spouses that stay at home with their children.

Now you can put the household income on the application for your spouse who stays at home. This will result in more applications, a better credit score (when you manage it properly), and more trips.

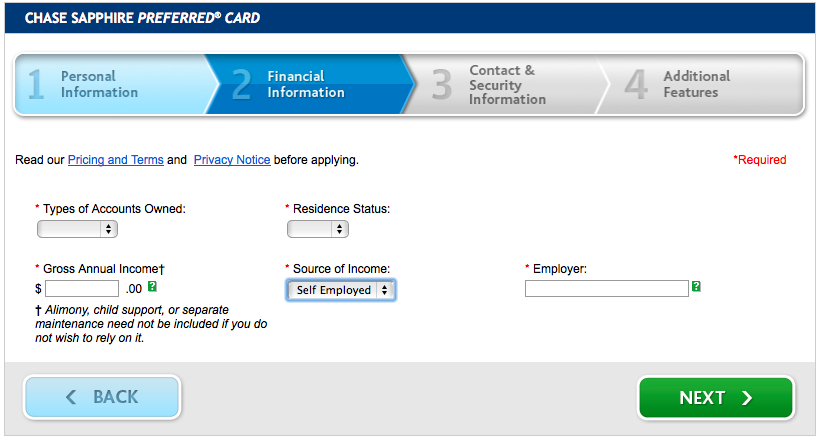

What about the Occupation?

As far as I can tell, the banks who issue the credit cards can still be more strict on approvals for homemakers if they see a higher risk of default among those consumers than those who are fully employed.

There isn’t any clear advice to give here about your non-working spouse, but you answer the question as you see fit. Oftentimes I’ll input “Self-Employed” for my spouse because of some businesses that we work on together. That is honest, and hopefully it gives her better chances of being approved.

Go Get a Credit Card for Your Stay-at-Home Spouse

Give it a shot. Your 800 credit score isn’t going to win you any awards. It might as well win you some points and miles! You might as well put a bit of stress on it to rack up more points and miles. You’ll be able to get double the amount of cards that you otherwise, which means more vacations and less out of your pocket.

Check out the Best Travel Credit Cards page and see which cards you need to get for your spouse that stays home.

Be Careful With Your Credit

As always. We preach responsibility along with this hobby. Never:

- Buy something on a credit card that you wouldn’t buy with cash.

- Carry a balance on your 20% interest credit cards.

- Apply for more credit cards than you feel comfortable getting.

- Be late for a payment.

Take good care of your credit because it is a useful tool you’ll need to finance larger items. Never allow yourself to rack up debt on credit cards or all the benefits of this hobby will be negated by the massive interest you’d be paying.

What has been your experience? Have you been successful getting credit cards for your stay at home spouse?

We haven’t had a problem with having us both get cards (so far.) as a stay at home mom for some reason my credit limit is always higher than my husbands!

@Christina- Who cares about the credit limit anyway, right? All we want are the points! 🙂 Glad to hear that you’ve been worldwanderlusting!

This post must have been for me. Want to let all the readers know real quick that my wife doesn’t work and she just got approved for the Chase Sapphire Preferred Card. It was way easier than I thought it would be to get and seriously only took 10 minutes to apply for. Approval was instant and we had the card within 10 days.

Tyson- So glad to hear that you’ve jumped on board. After watching Clint do his awesome trip, I’m sure you have a little travel envy. I do.

I am a stay-at-home mom, and I have been approved for all of the cards that I have applied for. I have received 7 reward cards in the past year and a half.

Amanada- Glad to hear that you’ve been taking advantage of this fun hobby/money saving activity. We would love to have you write a guest post for us sometime about what you’ve done with your 7 cards!!

Sheldon:

My wife is a home-maker but also doesn’t have SSN. She does have ITIN. Is she still good to apply for CCs? Thanks.

Hmm. Here is a Flyertalk Thread that shows some people having success. It looks like each bank might make a different decision.

Pingback: How Double your Credit Card Sign Up Bonus (for most people) | WorldWanderlusting.com

Im still wondering, as a stay at home mom can I apply for credit with just my name and use my husbands income? I thought I heard I could but need to know for sure.

Richele-

Absolutely. Ask any judge, he’ll tell you that you are entitled to your husband’s income. I always use household income figures on applications for both myself and my wife.

Before even move in the U.S. and get married with my husband I was an authorized user on 2-3 of his credit cards. So when I moved to the U.S. I had already credit, I didn’t start from 0. Is a myth that they say “if they add u as authorize user doesn’t affect ur score” so I started at 620 and when I applied for the first card on my name my score automatically went to 720. The card was quicksilver from capital one. Due to some mechanical problem with our car we couldn’t afford the payments anymore and we had to give the car back to the bank. My husband s score went down to 500. And my score went down to 650 because I was authorized user on his cards.I added him on my card and few months later he is a 650. So have on mind that adding someone as authorized user is kinda like sharing the scores. Whatever the first user does affects the other user. I forgot to mention that I’m not working so for the card I used the household income and they approved me. And they gave me a $200 limit credit card and now I’m $750 (apr.-sept.)