For more than three years now, we’ve been blogging about how to take advantage of travel reward credit cards and take almost-free trips all around the world. We have hundreds of subscribers who read our posts the moment they come out. We have helped people plan amazing travels to the southernmost reaches of South America to the powdery beaches of the Caribbean. Seeing people embrace the idea is an incredibly satisfying experience.

We used the Arrival card to book this Tuscan Farmhouse for 2 free nights

But the one question we get – and we get it constantly – is “where do I start?” We always respond by educating people about their credit because we want to be sure that people understand we are in no way advocating debt of any sort. We say that credit cards should only ever be used as “purchasing instruments,” never buying anything you wouldn’t otherwise buy with cash, check, or a debit card.

But I think what people are usually asking is “What is a good card to start with?” As long as you have good credit (above 700), I think the card for most people to start with is the Barclaycard Arrival World Mastercard.

The biggest reason is that using it doesn’t require knowledge of a complicated points-exchange system. Far too many people get confused by the idea of “miles” and how many it takes to get somewhere. Sometimes the booking systems are overwhelming. And while I do want you to make the time to educate yourself about these things… they can come later. Our first objective is to get you wanderlusting!

The Barclaycard Arrival World MasterCard offers a generous 40,000 point bonus once you spend $3000 in the first 3 months. That simply translates to $400 in free travel which you redeem by reimbursing your account for approved travel expenses. Those expenses might be car rentals, cruise bookings, airline tickets, hotel rooms, or anything booked with an online travel agency – even a package that might include a show.

The way you use it is so easy. Once you have made a travel purchase, you log into your account which greets you like this:

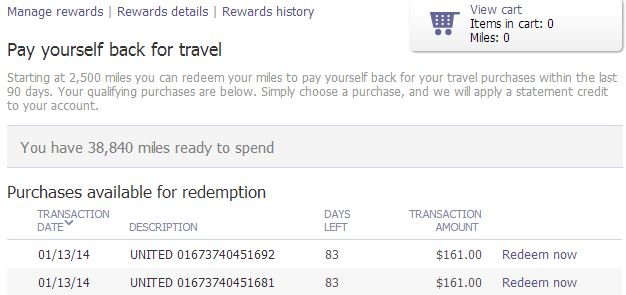

You can see that I’ve already burned some points but I still have 38,840 which are worth $388 in free travel. I click on “Redeem now” and it shows me if I’ve made any purchases which I can reimburse with points.

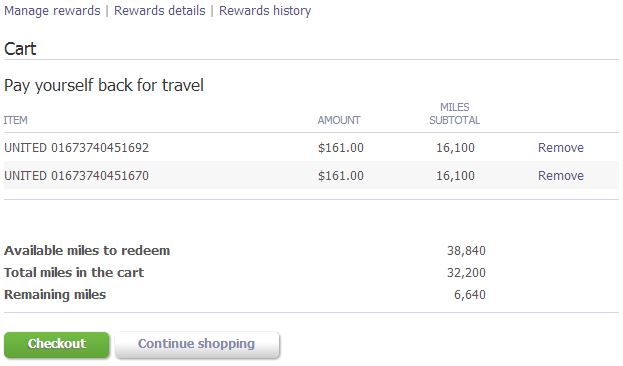

I happen to have a couple, so I click on “Redeem now” again and it puts them in my cart.

I check out and my account trades points in my account for dollars against my balance! It’s a beautiful thing. Even if I’ve already paid my card down, I can reimburse myself any time within 90 days.

But wait, a little bit like an infomercial it gets even better. Every time you use your points, they give you a 10% points-kickback. That means in this case, I instantly have 3200 more points or another $32 in free travel.

Every dollar I spend on the card gives me 2 points, so effectively every dollar I spend on the card gives me 2.2 cents in cash back for travel.

The flexibility and simplicity in using this card and its points is what makes it really nice.

To read more about what we’ve shown you can use this card for, check out some of these other posts.

To see other travel rewards cards, visit this Best Travel Credit Cards page.

Hey Brad, just got this card a little bit ago based on your recommendation. My questions is, are there stipulations regarding “purchases available for redemption?” Do they purchases have to be through a major vendor i.e., Delta, United or can you redeem points for purchases made via Expedia, Kayak and the like?

@Brandon- Congrats on joining the ranks of World Wanderlusting. You’ll feel like you’re in the saddle in no time at all. Thanks for your comment and we look forward to hearing how you use the points.

I pulled these quotes from their site to further answer your question:

As you can see, they are pretty open on how you use the points. You can use Expedia, Kayak, Orbitz, or any other discount site.

Let us know where you go!

How do you compare the Arrival card compared to the CapOne Venture card? It seems they have equal benefits (+/-), but most travel bloggers seem to push the Arrival card more. Any thoughts on why? Thanks!

@Glinton- Great question. There are a couple of reasons that you hear more buzz about the Arrival card over the Capital One Venture. Let me share with you the reasons why:

Those are all the reasons that came to mind for me. Does that answer your question?

Great card to start with! I just recently got this Barclay card and I’m on my way to the 40,000 miles – it’s so easy for normal spending. I’m still not quite sure how to reimburse myself or exactly what part of travel it will cover… we’re headed to Belize in May and I’m wondering if it covers expenses while there or no? Thanks for your help!

@Kiera, Glad to hear that you’re joining the ranks as well. We’re glad to have you here, and more excited that you’re on your way to more travel for less cost!

Here is a post that might help you understand a few great uses of the Barclaycard Arrival.

In short, you should be able to use the card, and be reimbursed for rental car, hotels, travel agencies or tour operators, or your flight getting there. Let us know if you have other questions.

May is coming up quick. Are you going to be doing a lot of diving? What else is on the agenda for your trip?

Thanks for the information! BTW, are these points transferrable to another airline, or only by paying with the card, and redeeming the points? I would like to transfer some points to aadvantage where I have 53000 miles currently, or to my delta points.

Keven- Thanks for commenting. These points can only be used to reimburse expenses. To transfer to American you’ll need some Starwood Preferred Guest points and to transfer to Delta you can use American Express membership rewards.

You can always use the search bar or the categories drop down on the right side of our site to see what we’ve said about some of these things.

We’ve had the Barclay card since November but logged into the site for the first time to figure out how we’ll use the points. We ended up redeeming $500 from a purchase we made from Get Away Today for Disneyland tickets in December. Love it!

Just got this card for my husband. Looks like it has changed slightly, it’s not $3000 in 3 months, not $1000 anymore. Too bad but still doable. Just wanted you to know, thanks!

CORRECTION: it IS $3000 in 3 months now, not $1000

Thanks. This change just happened today. Ouch!

oHmOHkOvI55A

Are any of these cards available with “chip and pin”?