One of my friends sent me an email yesterday about wanting to take his family to Costa Rica. Who doesn’t want to visit a beautiful country with delicious food? Not sure, because I sure do. Eating casados and spending time on beautiful beaches is something I definitely don’t do enough.

We want to help him take his family there as well. Worldwanderlusting wants everyone to visit Costa, Europe, Asia and more.

Because it is likely some of you are in the same boat, I thought I’d share the question and my answer with everyone:

Like a total noob (I’ve always avoided extra credit cards and when I finally thought I’d get one, I got duped into bank of amerca’s travel ‘rewards’ program). I ended up racking up a stupid balance (nearly $2500) on a card which is essentially unusable. I thought I’d be able to apply my points earned towards a ticket, but what they don’t tell you up front is that the points aren’t redeemed like that and so i have 29,000 worthless points.Anyway, I want to transfer my balance from this card to one where I can actually gain travel miles to use for a trip to costa rica on spirit airlines (which is the cheapest).What do you recommend? The best case scenario for me would be to:a. transfer my balance to a lower interest cardb. have immediate bonus miles on signup that can be applied to a ticketWhat are your recommendations? It doesn’t matter if I have to pay an annual fee.

My first recommendation is to quickly pay the balance on the card. Even though there are options listed below that defer the interest for up to 15 months, I would not recommend carrying a balance on your card. Paying high interest rates can quickly erase any bonuses or points earned on the card.

Here are my suggestions on what he looks at to help lower the overall cost of his Costa Rican Vacation with his family.

1. US Airways World Mastercard, which is issued by Barclaycard. They offer:

- 30,000 Bonus miles with first purchase

- 10,000 Bonus miles with your balance transfer

- $89 Annual Fee

- $10 or 4% for the balance transfer, but then offer 0% interest for 15 months.

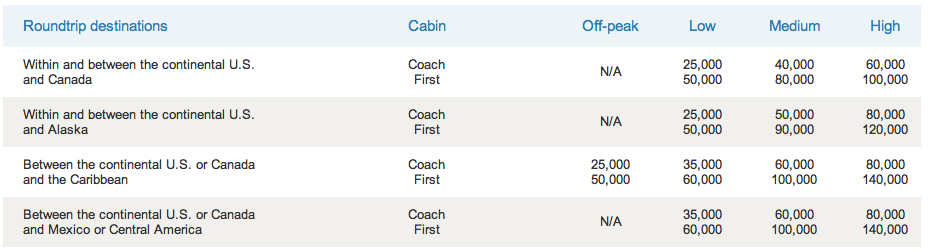

- 30,000 with the card to redeem to Costa Rica Round Trip (unfortunately you must book both the coming and going ticket when booking the flight. They don’t allow for one way redemptions. (See Below) It shows a 35,000 requirement, but having this card lowers the redemption by 5000 miles, which equates to the 30,000. You might have to be flexible when finding the flights because it sometimes can be hard to find the “Low” award availability.

- 3% foreign transaction fees

- Here is a link that I found that offers 35,000 with the first purchase and waives the $89 annual fee, but I can’t guarantee its performance.

- Bottom Line: This is the best option for your balance transfer (You’ll make up the 4% in roughly 3 months), and a single round trip ticket on US Airways.

- US Airways Redemption Chart

2. Sprint Airlines World Mastercard which is issued by Bank of America. They offer:

- 15,000 Bonus miles with first purchase

- $0 Introductory Fee for the first year. After that, your Annual Fee will be:$59 for World MasterCard accounts

- $10 or 4% for the balance transfer, with a 16% interest rate roughly

- Redemption varies depending on when you could go. They don’t have their “off-peak” options available anywhere that I can find, but the award chart varies depending on your flight origination and the destination. Here is an old chart showing their awards.

- 3% foreign transaction Fees

- This card hasn’t received raving reviews from the redemption of the miles.

- Bottom Line: This card hasn’t received great reviews based on redemption, and I can’t even find their “off-peak” calendar anywhere around. The Balance transfer interest rate is really high, but it offers on annual fee the first year. It would be the best if flying out of one of the Florida locations to SJO because it requires less miles than flying out of many other locations.

3. Barclaycard Arrival which is issued by Barclaycard. They offer:

- 40,000 Bonus miles after spending $1000 on the card within the first three months of card membership.

- $0 Introductory Fee for the first year. After that, your Annual Fee will be $89

- $10 or 4% for the balance transfer, with a 16% interest rate roughly

- Fly on any airline and save up to $400 total

- NO foreign transaction Fees

- Bottom Line: This card is the easiest for redemption because you can pick any airline without restrictions. It waives the annual fee, but doesn’t give you a great interest rate on the balance transfer. It would also be great for your time in Costa Rica as they offer no foreign transaction fees.

In an ideal world you could:

- Get both the US Airways and the Barclaycard Arrival for yourself at one time.

- Book one ticket on the reward redemption with US Airways for one of your children.

- Then use the Barclaycard to subsidize $400 of the rest of you on the same flight offered by US Airways.

- By flying with US Airways you avoid the baggage fees that you would face with Spirit airlines.

- Better yet, your wife could do the same thing by getting both cards, which would make the trip kuffin cheap!

You would be out:

- $89 Annual Fee for the US Airways Card x2 = $178

- 4% of $2500 for the balance transfer = $100

- Award Redemption Fees Roughly $100

- Charges above $400 for the other two Roughly $200

- Grand Total for 4 to Costa Rica $678

As always, we really want you to take good care of your credit. Make the decisions based on your situation and what is best for you. If you have more questions about your credit, check out our What About My Credit Page.

Don’t forget Frontier flies to Costa Rica and has a co-branded CC too.

Good Call Ken.

My husband and I each got a Delta Gold Am Ex personal and business card in January. That gave us each 60,000 Delta points very quickly since the spend was only $750 per card. By April we were cruising the Delta award options to Liberia, Costa Rica for January 2014 and scored tickets for 47,500 points each. We could have booked for 35,000 points but opted for the other due to preferred flight times. Couldn’t be happier!

Nice. Where did you get an offer for 60,000? That is a great deal for a Delta card. They are usually pretty stingy. How great that you’re headed there. It is a wonderful place to visit as long as you spend time in the right places. Enjoy the casados (a meal).

The personal card was 30,000 and the business card was 30,000. Husband and I both did both!