We’ve posted time and time again about this card. Here are a few great posts to review

- Using Credit Cards to Explore Europe

- First Time Using Starpoints

- Alpine Europe Starwood Review 1

- Winter Getaway with Starwood Preferred Guest

- Cruise Connection and Disneyland Base

In my opinion this is the most valuable offer for a hotel credit card that I’ve ever seen. The bonus is worth 10 nights at Category 2 hotels. With each night being valued at $150, this card will give you $1500 in value.

My Love for the Starwood Program

Because my wife and I were both able to hit the bonus last year I’ve definitely come to know this program. In the past year I’ve stayed for free at:

- Charleston, SC Aloft (2 Nights)

- Salt Lake City, UT Sheraton (2 Nights)

- Dallas, TX Element (1 Night)

- Dornbirn, Austria Four Points (1 Night)

- Bolzano, Italy Four Points (1 Night)

- Padova, Italy Sheraton (2 Nights)

- Milan, Italy Four Points (1 Night)

- South San Francisco, CA Four Points (3 Nights)

Yep, you’ve counted that right, thirteen nights for free in the last year. The best part is that we still have almost 60,000 Starpoints left over for future use. My only regret is not staying longer at most of the properties. You’ll see once your Starpoints account begins to grow with the bonus how exciting it can be.

The card is so useful to me that I even kept it and paid the annual fee this year. Basically for every $3000 I spend on the card I can get 3000 Starpoints. That many Starpoints is one free weekend night in a Category 2 hotel. I value that at $150. That’s almost 5% cash back for something that I love, travel!

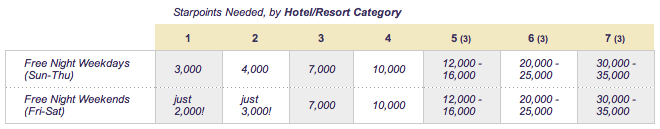

How Many Starpoints Does Each Night Cost?

I’ve always found it best to use the lower level redemptions to make the points last as long as possible. Starwood has an abundance of Category 2 and 3 hotels all across the world. You can do a category search (Use the button in the upper right hand corner to change the category) to see where your Starpoints will take you.

Remember to Subscribe to our blog by putting your email address in the upper right hand corner of the blog so you never miss another deal.

How long do you have to wait between Amex apps? I just did a 3-card AOR July 16th but really want this card. I also really want the Chase SW business card to get Companion Pass status.

@Ken- No specific guideline has ever been given about Amex apps. I’m sure if you can justify the app they will issue the card. You might want to use their reconsideration line if you get denied. You might be able to close an old card in order to get approved for this one. You don’t want to miss this offer.

Do you lose your Starpoints if you cancel your CC after 1 year if you haven’t used them? Do you lose your reward points earned with other CC when you cancel the cards or are they yours to keep?

@amanda- No. The points will stay in your Starwood Preferred Guest Account.

The general rule is if the points are issued by a bank (Chase Ultimate Rewards, US Bank FlexPerks, etc) then the points will be gone when you cancel the card if you still have Ultimate Rewards. If the points are issued to a specific company ie: Marriott, SPG, United Airlines, American Airlines, etc then the points will not be lost when you cancel the card.

If you can have one card that you spend over $15,000 a month on for business purposes, which card would it be? Switching cards around is easy for our personal stuff but not for our business where we have various employees and auto drafts tied to the card.

@clint- Your Capital One Venture card is a good option for someone who regularly spends lots of money. 2% back to you for every purchase and the points must be used for travel. That is nice because you can fly the flights and accrue the miles of your flights too.

The Ink Bold/Plus from Chase would probably be a bit better. You can earn 5X points per $1 on the first $50,000 spent annually at office supply stores, and on cellular phone, landline, internet, and cable TV services. Earn 2X points per $1 on the first $50,000 spent annually at gas stations and for hotel accommodations when purchased directly with the hotel. Earn 1X point per $1 on all other purchases, with no limits on how much you can earn- redeem your points for what you want through Ultimate Rewards.

That would help you to accrue more points faster there. The best part about the Chase Ultimate Rewards is that the points can be used as cash (just like your Venture card), but it also can be transferred to United Airlines, Southwest Airlines, Hyatt, British Airways, Marriott, and Korean Air. This gives you greater flexibility of where you can use the points than the Venture card does. Employees can get cards at no additional cost.