We always tell our readers to make sure that they are making wise decision about their credit when they begin applying for new credit cards. If anyone is going to be applying for a big loan in the near future, I would always recommend that you exercise much caution.

Remember that credit is like an onion. (Do I sound like Shrek?) As you establish the credit with different accounts it builds and makes your credit more stable. If you are new to the credit game then I would always recommend that you exercise much caution by making sure that you establish a good foundation first.

My wife is pretty new to the credit game, and you can tell that it affects her credit more than it does mine when she applies for a new line of credit. Last month she scored the Starwood Preferred Guest card on the last day of the promotion. She opened her first line of credit in 2008 with a bank credit card. It was her only line of credit at the time and has kept it open and paid great on that account every month since then. It has grown and become more established since then. In the beginning of 2011 we applied for her second credit card and she got the AAdvantage 75,000 deal.

The Capital One “Match my Miles” promotion was too tempting to let it pass us by. She had over 100,000 miles with American because of the above mentioned promotion and she scored this as her third card. I knew that because she was new to the game I had to be more cautious with her credit than mine as mine has been established for much longer than hers.

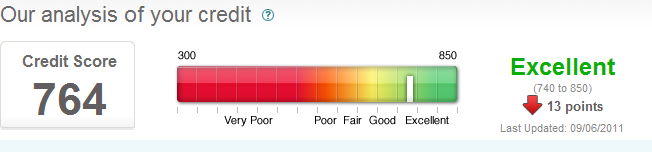

I wanted to make sure that she was able to get the the Starwood promotion because I felt like it was such a great deal. I was a little nervous applying for it because I knew that her “onion” didn’t have a lot of layers, and needed to be cared for. I just checked her credit score with CreditSesame.com and I noticed that over the last month her score dropped by 13 points. It is ok because we don’t have any loans that we are going to be needing for the near future and we will be able to bring her score back up again before we end up needing another loan. Her score is still in the excellent category as it now sits at 764.

The interesting thing is that my score actually increased during the month for which I applied for the Starwood Preferred Guest card. This just goes to show that your “onion” or credit needs to be well established before you enter this world of wanderlusting on credit cards.

The interesting thing is that my score actually increased during the month for which I applied for the Starwood Preferred Guest card. This just goes to show that your “onion” or credit needs to be well established before you enter this world of wanderlusting on credit cards.

CreditSesame.com has been a great addition to me and I would recommend it to everyone who is following this strategy. It gives you an updated score every month based on the Experian score. They don’t provide you with the report, but it helps you to understand where your current credit situation sits.