Worldwanderlusting.com recently did a guest post for a blogger friend of ours, www.utahdealdiva.com. The Deal Diva posts about coupon opportunities and other bargain-hunting activities.

She asked us to concoct some vacations a family of 5 could take for less than $1000. If you know what we do, you know that this is right up our alley. We write about inexpensive ways for people to get to places they had only dreamed of going. We hope to inspire others to travel – to infect them with a serious case of “wanderlust.” Nothing pains us worse than hearing people say, “I’d love to travel, I just can’t afford it.” Bookmark our site and you’ll find that we’re pointing out ways you can travel cheaply by taking advantage of credit card travel offers and seizing good deals when they come up.

Here’s our first guest post about am inexpensive Moab Roadtrip.

To the young family, the road trip is, as Dickens says, “the best of times and the worst of times.” Well, honey, pack the minivan and load up the kiddos, we’re going to go for it and try to focus on the best of it!

We’ll begin with a road trip that will take you from deep canyons to high arches and from the dinosaur-desert of Vernal to verdant mountains around Park City. There will be something for everyone in your family – adventures for the little explorers, knowledge for the history-seekers, and picturesque views for the landscape-lovers. This is a great springtime trip, and it just happens to be what our family is embarking on today.

What will this trip cost?

- Fuel: $120 for the Camry. $250 for the Denali. It’s a total of about 750 miles, so divide 750 by your MPG and multiply it by a disgusting $3.70.

- Park Entrances: $80. Opt for the pass… you’ll be doing things like this a lot more often.

- Food: $160-$200 if you’re cheap like us.

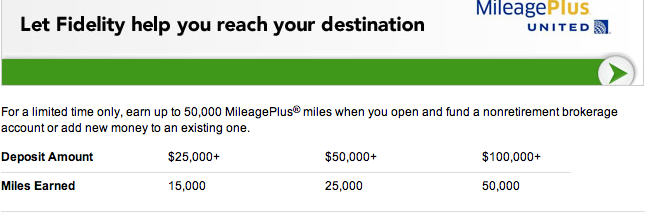

- Hotels: $380, or start Wanderlusting with the Marriott Rewards® Premier Credit Card for two of your three nights free or the Chase Sapphire PreferredSM Card and get yourself $500 in free travel cash.

- Other: $100 Even if you’re cheap (and we are) you’ll find other things to spend money on.

Total: $460-$880

Day 1

Be sure you have your fruit snacks and Capri Suns. Pop in “Finding Nemo” to ensure that the kids pay no attention to the beautiful scenery you’ll be passing. Drive from the SLC area to Canyonlands National Park by way of Price and Green River. You may even want to pack a picnic to eat once you make it to Canyonlands.

For the explorer: Canyonlands is a paradise for both intrepid and amature explorers. Try out the hike to Upheaval Dome in the Island in the Sky district. In the Needles district, you’ll want to do the Joint Trail, which will take you through some amazing deep slot canyons.

For the history-seeker: It’s hardly ancient history, but Blue John Canyon in the Horseshoe District of Canyonlands park was the scene of the tragic accident that was the subject of the movie, 127 hours. If you’re not familiar with it, it tells the story of a man who was forced to amputate his own arm in order to escape being pinned between rocks in the canyon. If you’re looking for older history, the Maze District was a hideout for Butch Cassidy and the Sundance Kid.

For the landscape-lover: You have at least a trio of breathtaking vistas in the combination of Dead Horse Point, the Green River Overlook, and the Chesler Trail. If those were the only amazing scenery spots you could find, they alone would be worth the trip, but fortunately you’re just getting started.

Overnight: Hotels in Moab are not cheap and point reward redemption is generally not an option. Chase Ultimate Rewards points allow you to use your points as cash at a good rate… I’d say opt for the Hampton Inn with a rockin’ complimentary breakfast, $180. Or you may be able to sneak by with the Days Inn for a little less.

Day 2

Start your day with adventures in Arches National Park then make your way to Grand Junction.

For the explorer: Young families may not be swinging on the Corona Arch (you’ve got to see this video!), but there is plenty to do. Obviously the main activities will be hiking, biking and rock climbing, and your little ones may enjoy trying to spot the colorful Collared Lizard doing pushups.

For the history-seeker: Stop in on the Wolfe Ranch Cabin in Salt Flats – home of one of the first permanent settlers in the area. It’s more than a century old- preserved by the dry air of the desert climate.

For the landscape-lover: Take a family picture with Delicate Arch as a backdrop, snap some off with Courthouse Towers, or immortalize the contrast of the red rock of arches against the La Sal Mountains. This is a place where God’s artistic hand has been working the canvas for thousands of years. The problem will not be finding things to marvel at, it will be finding things not to marvel at.

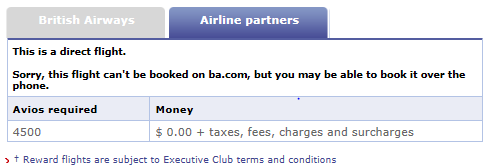

Overnight: If you get into Grand Junction in time for a late dinner, Check out Pablo’s Pizza (not your average pizza joint). Then check in to the Courtyard Grand Junction, where you could stay for free with 15k of 50k points and an extra free night you get for applying for the Marriott Rewards® Premier Credit Card. Otherwise, there are 4 or 5 hotels you can get for less than $70 a night on Hotels.com.

Day 3

Drive to Vernal, possibly taking a couple of sidetrips out to Fantasy Canyon and Dinosaur National Monument.

For the explorer: This short trip won’t allow you to do a river rafting trip, but the road into the Quarry at Dinosaur National Monument will offer plenty of chances to scout the river. You can also be on the lookout for petroglyphs.

For the history-seeker: Dinosaur National Monument will have you spellbound as you take in the 1500 fossilized remains that are exposed at the Quarry. There are few sites like this one in the world, truly giving you a taste for what the world was like in a time when dinosaurs roamed.

For the landscape-lover: Again, beautiful sites abound – starting with the Colorado National Monument just outside your origin and all along the way as you wind your way towards Vernal. If your landscape-love is harder to quench, make the off-road trek to Fantasy Canyon.

Directions:Roughly 27 miles southeast of Vernal. Travel east out of Vernal on US 40 through Naples. Follow the sign marked “Book Cliffs Access.” Continue south, crossing the Green River after seven miles; from this point continue on for another 12 miles until you see a sign on the left for Fantasy Canyon. Follow the small signs along this dirt road until you arrive at the Fantasy Canyon parking area. Do not attempt this clay road during or after a rain, since even a four wheel drive vehicle will slide right off the road’s edge. Be sure you have plenty of fuel and water and don’t get lost.

Overnight: Vernal has a very new (and very nice) Springhill Suites where you can stay for 10k Marriott Points.

Day 4

Before leaving Vernal, get breakfast at Betty’s Cafe (unless you did opt for the Springhill Suites and already indulged in complimentary breakfast). You’ll be driving a fair amount today, but break it up with stops at whatever seems interesting.

For the explorer: It wouldn’t hurt to stop in for a run on the Park City Alpine Slide. Other than that, there are dozens of pull offs where you can stop in on State parks and possibly see some wildlife.

For the history-seeker: If the kids (or the adults for that matter) aren’t dinosaur-ed out, you’ll want to visit the Utah Field House of Natural History Museum. There are hands-on activities and more background to the prehistoric stories that innundate the area.

For the landscape-lover: I doubt you’ll tire of the desert panoramas, but by the end of your return to the Salt Lake Valley you’ll be refreshed by some greener scenery. To add to the picturesque mountain drive, take State Highway 35 through Wasatch National Forest.

We hope you enjoyed our Canyonlands/Arches/Dinosaur Road Trip loop. If you make the trek, come back and comment to share what other wonders you discovered. We hope that this will be the first of many adventures we take together.

It isn’t too many miles, but if you were going to join the popular Netflix service then you should consider using one of these links to sign up.

It isn’t too many miles, but if you were going to join the popular Netflix service then you should consider using one of these links to sign up.