Here’s the executive summary:

- Sign yourself up for the Hawaiian Airlines World Elite Mastercard

- Spend $1000 in everyday expenses the first month on this card, pay it off immediately

- Pay an $89 annual fee the first year

- Collect 36,000 Hawaiian Airlines miles

- Sign your spouse up for the Hawaaian Airlines World Elite Mastercard

- Spend $1000 in everyday expenses the second month on this card, pay it off immediately

- Pay an $89 annual fee the first year

- Collect 36,000 Hawaiian Airlines miles

- Book 2 free flights for 35k miles each (pay only taxes and fees ~$70) from the US to one of the Hawaiian Islands

- Sign yourself up for the Chase Hyatt Credit Card

- Spend $1000 in everyday expenses the third month on this card, pay it off immediately

- Pay no annual fee the first year

- Collect 2 free nights in any Hyatt hotel

- Book the two nights and start daydreaming!

Now, before you get too crazy excited, please realize that this post is mainly targeted to people who live in or near Hawaiian Airlines hubs like Los Angeles, San Francisco, Seattle, Las Vegas and New York. If none of those are close to you, you may also want to read our post about getting to Hawaii on American Airlines. Or check out How the AA/US Airways merger could get you 2 tickets to any of 64 countries.

—

Now for the more exciting version. This is something we’ve been doing for four years, telling the stories right here on this blog in over 600 posts on opportunities just like this one. It just so happens that I returned from a trip exactly like this just a week ago… and I can tell you it was amazing.

We visited Maui and Kauai and blended adventure with relaxation and some delicious food. We paid something like $60 per flight and stayed 2 free nights in the Hyatt Resort Kauai… which is really not a bad place to spend two nights…

We splurged on a $165 meal for two at Mama’s Fish House and didn’t feel the slightest bit of guilt (ok, maybe just a little bit).

We scuba-dived at night, watching an octopus crawl across the reef, changing colors and textures, and seeing an eel stalk a fish and then swallow it whole.

We rode bikes down the Haleakala volcano. We hiked through bamboo forests and bathed in 400 foot waterfalls. On the Road to Hana, a gecko hitchhiked on our windshield. We laid on the beach. We relaxed by the pool.

It was everything a vacation should be, and just as we always do, Nicole and I were left wondering how other couples manage to get the time together that we are only ever able to get by traveling.

But this wasn’t something we achieved by scrimping and saving, it’s something we did by prudently using our everyday spending to meet credit card minimum spending requirements to obtain frequent flyer miles and travel for free. It’s the same recipe that’s taken our entire family of six to five different countries, and opened the door to the world of almost free travel… and it something you can do, too.

Almost-free flights

Right now there’s an offer on the Hawaiian Airlines World Elite Mastercard that will earn you 35k points after spending $1000 within the first three months. Applying for this card will affect your credit score slightly, as any credit inquiry does, but not to a degree that offsets the amazing benefit you get. As I mentioned in the summary, the card does charge an $89 annual fee – but when you’re comparing it to a $1000 flight price, it seems pretty minor.

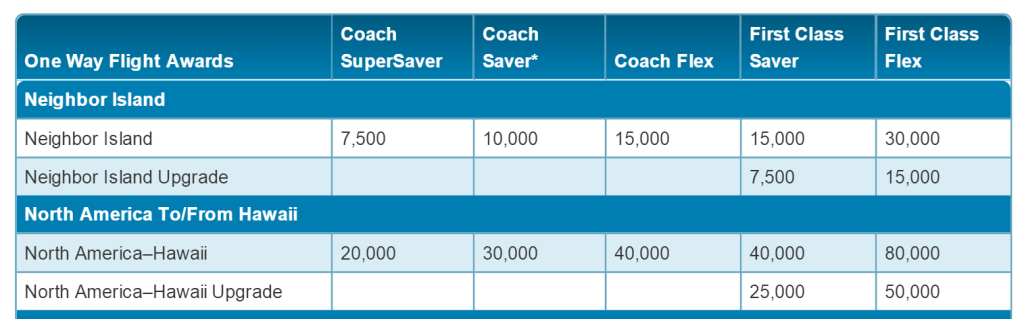

Hawaiian Airlines SuperSaver

Because your spouse has separate credit, they can also apply independently and reap the same reward.

If you’re like us, spending $1000/month comes pretty easily and between fuel, groceries, utilities and some entertainment, you can just replace spending that you usually put on a debit card or pay with cash.

After two months you’ll have met the requirements and the points will be on their way. Once they arrive, you log on to www.HawaiianAirlines.com and find availability at the SuperSaver level for dates that will work for you. Because you’re a cardmember, you’ll have a 5k point discount on RT travel, so knock 5k off the 40k and you’ll have enough. You may need to be somewhat flexible to make it work, and maybe it will even mean going to a different island, but I’m here to tell you that there’s nothing disappointing about any of them.

2 free nights in a Hyatt Resort property

One of the most awesome deals out there in the world of travel-reward credit card usage is the offer on the Chase Hyatt Credit Card. It’s as simple as signing up for the card and spending $1000 within the first 3 months. Then you get a certificate to book 2 nights at any available Hyatt Property.

It works out nicely that there are 5 Hyatt resorts across 3 different islands, so you have a lot of options.

As I mentioned, we stayed at the Grand Hyatt Kauai Resort and I have to say that the place is absolutely incredible. The grounds are unlike anything you could imagine – with a lazy river flowing through an abundance of flowers, a meandering saltwater lagoon, and, an abundance of gorgeous beach.

No, this is not a Hyatt advertisement, but it should be. This is Nicole on the balcony.

Almost no matter how you go about it, the benefit on this card is going to be in the $800 range because these hotels are not cheap. Consider this your splurge and find a quaint B&B to spend the rest of your time in.

FAQ

When do the points expire? Your Hyatt certificates must be used within 12 months, and the Hawaiian Airlines points require activity every 18 months in order to keep them.

What if you don’t keep the cards? From Hyatt’s terms: “If your account is not open for at least 3 months, Hyatt and Chase reserve the right to deduct the Free Night Awards from your Hyatt Gold Passport account.” On the Hawaiian points, even if you don’t keep the card, you can keep the points, but it’s probably best to book while you have the card or you don’t get the 5k point discount.

Aren’t rental cars in Hawaii expensive? Not a chance. We booked a full-size car for $200 for 5 days. Be smart about it. Use www.CarRentalSavers.com.

Doesn’t it hurt my credit to apply for credit cards? Probably not as much as you might think. We have a whole post about this.

More questions? Ask them with a comment, below.

Like the idea? Subscribe to our blog.

Love the idea? Share this post on social media!

Thanks for wanderlusting with us.

In need of help. I applied for the Hawaiian today and because I recently acquired the Barclay US Airways card my application is now under review. Do j apply for the Hyatt while I wait for a decision or wait until the Hawaiian deal is final and then apply for Hyatt. Sorry if this is brief. Trying to complete on a lunch break