This post may seem a bit elementary to you, but the objective here is to show you how easy it is for you to use the points that you’ve recently banked from picking up the Barclaycard Arrival Plus credit card. Once you meet the spending requirement you’ll have over 40,000 points to redeem for your travel expenses.

Link:Barclaycard Arrival Plus World MasterCard®

Check out this list of some of the best places that you can use the points from the Barclaycard Arrival. If you’re a romantic trying to score some points with your sweetheart, read up on Brad’s post about how you can use the points from the Barclaycard Arrival for some hotels that you’ll never forget.

It’s kinda like an indulgence without a cost. You know that you shouldn’t be spending $106 to visit the Kennedy Space Center, but it feels so good in the moment. You just log in to your Barclaycardus.com account and make the purchase disappear. Man, if real repenting in life was only this easy!

Steps to Using Your BarclayCard Arrival Plus

First you’ll need to log in to your Barclaycard account by going to www.barclaycardus.com.  It should look something like this when you go to the website.

It should look something like this when you go to the website.

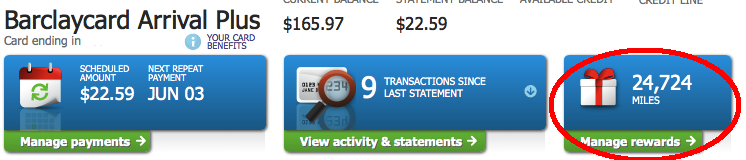

Next you’ll want to Click on “Manage Rewards” which is found on the right hand side of the page. (see below)

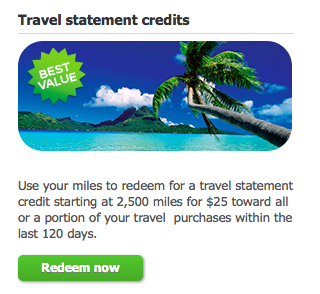

From there you’ll want to click on “Travel Statement Credits.” It has the picture of paradise, heaven, umm maybe bliss… Well, you get the picture.

There are a couple of things to remember when you’re trying to redeem the points from your newly acquired Barclaycard Arrival:

There are a couple of things to remember when you’re trying to redeem the points from your newly acquired Barclaycard Arrival:

- Minimum purchase price is $25

- Must be redeemed within 120 days of the expenditure

- Purchase must meet the requirement of being a travel-related expense.

- You must use the points for an awesome unforgettable trip to somewhere completely awesome.

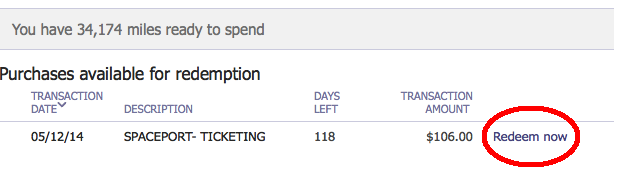

Next you’ll see a list of travel related expenses for which you can redeem your ridiculously awesome Barclaycard Arrival Plus points.

In my case I had 34,174 points in my account before completing this redemption. I wanted to use some of my points for the tickets that I purchased to see the Kennedy Space Center in Cape Canaveral, Florida. Wait a minute, yeah you heard me right. I totally used the Barclaycard to cover the entrance to see some awesome exhibits about rockets, history, and space. Yeah. Why don’t you have this card again?

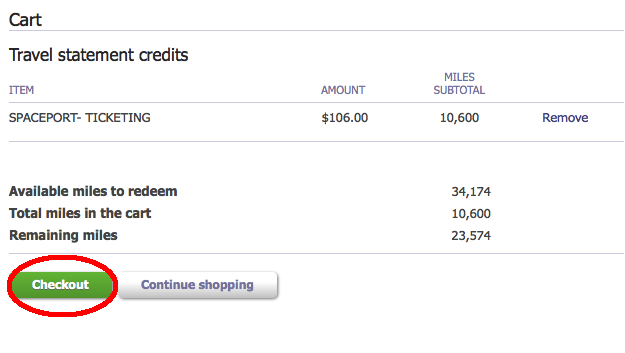

I chose “Redeem Now” from the above screen, which brought me to my shopping card of free stuff. They show you how many miles you have, how many you’re redeeming, and what you’ll have left for your next trip.

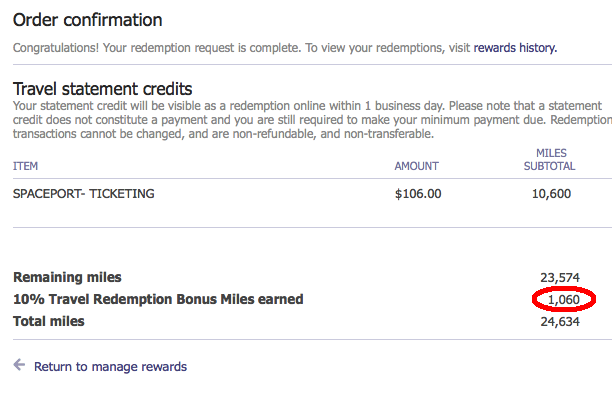

Now that I used 10,600 points for an trip to space, (the closest I’ll get to space for a little while) the kickback dropped back in my account. Once I’ve erased the $106 entrance fee to the Kennedy Space Center you’ll see a credit on your credit card account for the amount of $106.

I also used this card to cover the cost of the rental car that we used on the trip to Florida, which also shows as a credit on my account completely washing away the cost of the rental car.

I also used this card to cover the cost of the rental car that we used on the trip to Florida, which also shows as a credit on my account completely washing away the cost of the rental car.

Now I’m back to the drawing board. I’ve still got roughly $250 on this card and once I meet the spending requirement on my newly acquired Arrival Plus I’ll have almost $700 in purchases to erase. It’s really that simple. Once you’ve made the travel expense you can go in and erase the expense from your history.

Sheldon,

I’m using this card to help pay for a cruise in September. I have about 50,000 points available but the total will be about $900. If I pay for it all using this card, will I be able to get the $500 statement credit? Or should I divide it into two payments – one for the amount of points I have and one for the remainder?

Brady- You don’t necessarily need to break up the charges. If you have a $900 purchase, but only 50k in points, you can still use your points to redeem $500 of the $900.

But… if you can, one thing you may want to do is break up the charges so that you can take advantage of the 10% kickback. For example, you charge $500 of the cruise now, and $400 next week.

Then, once you use your 50k points to get $500 back, you’ll have 5k points kicked back. Then you can use those 5k points to offset $50 of the remaining charge for $400.

Beeeeeauuuuuuuutiful!

Pingback: The BEST Barclays Credit Cards | WorldWanderlusting.com

ok- i feel like such an airhead. i have this card, and have about 50K points in my account after the bonus. i thought redeeming miles for this card were easy peasy (like my sw or chase cards), but i’m stumped. what do i do?? i understand that travel statement credits are best, but how do i do that? we’re planning a trip to hawaii in 2015, and are flexible on dates, etc., and will also use my husband’s points (he has the card, too, he’s just a couple months behind me so we could both get the bonuses), but how do i actually redeem my miles? help!? is there some explanation for dummies like me on how this works? 🙂

Amanda- Sorry for the sluggish Christmas hangover response. This card is awesome. You just look on any website-orbitz, delta.com, hotwire, allegiant, basically anywhere and find the cheapest airfare you can find. Once you’ve found the flights you book it using this Barclaycard Arrival. After you’ve booked the flight (Let’s assume it was $550) you’ll be able to reimburse yourself for the $500 and it will show up as a $500 credit on your credit card statement. So you’ll have a charge for $550, and a credit for $500, which leaves you with paying $50 for the flight.